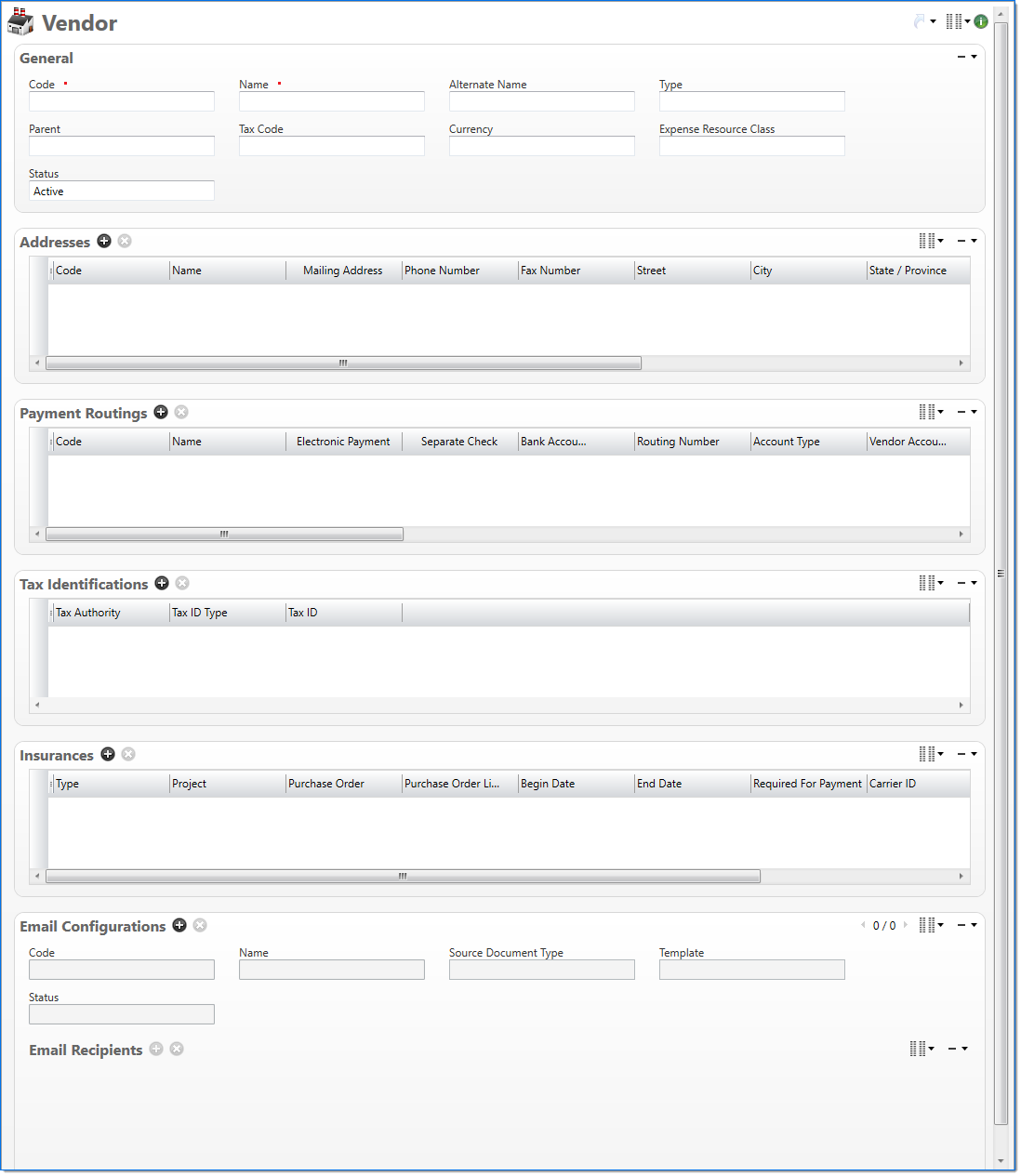

Vendor

The Vendor screen allows you add and define vendors. A vendor is an entity that provides goods or services to the company. Each vendor contains trade and relationship information that is used for vouchers and payments.

General

In the General area, enter basic vendor information.

| Field | Description | |

|---|---|---|

|

Code | Enter a unique alphanumeric key to identify the document. Once a code has been entered and the document has been submitted to final, it typically cannot be changed. This field automatically prepopulates and be read-only if an auto-counter has been defined for this type of document. |

|

Name | Enter a name to describe the document. The name does not have to be unique. |

| Alternate Name |

Enter an alternate name for the vendor. For example, this name can be used on payment documents. |

|

| Type |

Enter or select an active vendor type. This is a reporting parameter that is used to group and sort vendor data. |

|

| Parent |

Enter or select the vendor's parent company. This could be necessary when a vendor has multiple divisions or affiliates. When used, this field allows multiple vendors to be grouped and reported on as one consolidated vendor. If the vendor does not have a Parent, this field can be left blank. |

|

| Tax Code |

Enter or select an active tax code. This will be used as a default when a tax is added to a voucher. |

|

| Currency |

Enter or select an active currency. This is used as the default currency during voucher entry. |

|

| Expense Resource Class |

Enter or select an active expense resource class. This is used to make the vendor available when you plan resources, create budgets, and calculate effort.

|

|

| Status | Select the status of the document. | |

Address

In the Address area, enter one or more addresses. It is used to track addresses of different locations. Multiple addresses can be defined. Each address code must be unique for the vendor.

| *Req'd | Field | Description |

|---|---|---|

|

Code |

Enter a code for the address. This must be unique to the document instance but does not have to be globally unique. |

|

Name | Enter a name to describe the address. This does not have to be unique. |

| Mailing Address |

Select if this address can be used to send and receive mail. If selected, Street, City, and Country are required. |

|

| Phone Number | Enter a telephone number for the contact. | |

|

Fax Number |

Enter a fax number for the contact. | |

| Street | Enter the street address. This field is required when Mailing Address is selected. | |

| City | Enter the city. This field is required when Mailing Address is selected. | |

| State/Province | Enter or select the state or province. This field is required when Mailing Address is selected and the selected Country is set to have States or Provinces. For more information, see Country. | |

| Zip/Postal Code | Enter the zip or postal code. This field is required when Mailing Address is selected and the selected Country is set to have postal codes. For more information, see Country. | |

| Country | Enter or select the country. This field is required when Mailing Address is selected. | |

| Status | Select the status of the address. | |

| Primary | Select if this is the primary address. |

Payment Routings

In the Payment Routings area, enter routing options to pay the vendor. The default columns are marked with an indicator (  ). For information on how to display the optional columns, see Manage Columns.

). For information on how to display the optional columns, see Manage Columns.

The payment control information (Bank Account, Routing Number, IBAN and Swift Code) is considered sensitive data. As such, it may or may not be displayed in reports or inquiries depending on the level of access privilege of the user executing the report or inquiry.

| Field | Description | |

|---|---|---|

|

Code |

Enter a code for the payment routing. This must be unique to the document instance but does not have to be globally unique. |

|

Name | Enter a name to describe the payment routing. This does not have to be unique. |

|

Electronic Payment |

Select if all vouchers using this payment routing should be paid electronically. |

|

Separate Check |

Select if a separate check should be generated for each voucher. If not selected, all vouchers selected for payment will be combined into a single check during payment generation. |

|

Include Country | Select if the country should be displayed in the address on the Payment report. By default, this option is selected. |

|

Bank Account Number |

Enter the bank account number. This field is required when the Electronic Payment field is selected. |

|

Routing Number | Enter the bank's routing number. This field is required when the Electronic Payment field is selected. This field must be numeric. |

|

Account Type | Select the appropriate account type. Choices are Checking, Saving, or None. This field is required when the Electronic Payment field is selected and that default is Checking. If the Electronic Payment field is not selected, the default is None. |

|

Vendor Account Number | Enter the account number assigned by the vendor. |

|

EFT Prenotification Required |

Select if the bank account number and routing number must be verified with the receiving financial institution before it can be used to pay vouchers electronically. For more information, see EFT Prenote Request. |

|

Payment Term | Enter or select an active payment term. This is used during voucher entry to calculate the default due date and discount |

| Payment Cycle | Enter or select an active Payment Cycle. This is used to group or categorize vouchers for payment purposes. | |

|

Locale |

Displays your locale based on your computer setting. This is used to define date and numeric formats. The locale is presented in ISO standard format by language and country to allow ease of localization. This table is pre-populated in BST11. |

| Attention | Enter a party, team, or department to use in place of selecting a Contact for the address on the bill routing. | |

|

Contact | Enter or select an active contact defined for the vendor. This is the person contacted about payments to the vendor. |

|

Address |

Enter or select the address where to send payments. This is required for non-electronic payments. |

|

Payment Return Type | Enter or select an active payment return type. This column is used to categorize payments for tax return purposes. The default is blank. Payment Return Types have a Tax Authority associated with them. The vendor must have a Tax Identification for the Tax Authority for that vendor. |

|

Payment Return Code | Enter or select an active payment return code. The available selections are limited based on the payment return codes defined for the selected Payment Return Type. |

|

On Hold | Select if vouchers for this vendor should be placed on hold by default. If Pay When Paid is selected, this field is selected and read only. |

|

Pay When Paid | Select if the vouchers for this vendor are subject to pay when paid terms by default. |

| IBAN |

Enter the International Bank Account Number (IBAN.) This field is used in conjunction with the SWIFT code in EFT transformations, particularly for international money transfers. |

|

| SWIFT Code | Enter the Society for Worldwide Interbank Financial Telecommunication (SWIFT) code. This field is used in conjunction with the IBAN code in EFT transformations, particularly for international money transfers. | |

|

Status | Select the status of the payment routing. |

Tax Identifications

In the Tax Identifications area, enter the tax authorities, tax ID types, and taxes to use in the company tax calculation processes. For more information about tax authority setup, see Tax Authority. For more information about tax ID Type setup, see Tax ID Type.

| *Req'd | Field | Description |

|---|---|---|

| Tax Authority | Enter or select an active tax authority. This is the entity to which taxes withheld will be remitted. | |

| Tax ID Type | Enter or select an active tax ID type. This defines the type of tax that you will enter in the Tax ID field. | |

| Tax ID | Enter a tax identification number. For example, you might enter a VAT registration number. |

Insurances

In the Insurances area, enter one or more insurance type instances. These are used to track different vendor insurance requirements for various types of goods and services which may be ordered. Multiple insurance requirements can be defined.

| Field | Description | |

|---|---|---|

|

Type |

Enter or select a code for the insurance type. It must be active. |

|

Project | Enter or select a project code to which this insurance type may be applied. |

|

Purchase Order |

Enter or select a purchase order to which this insurance type should be applied. |

|

Purchase Order Line |

Enter or select a purchase order line to which this insurance type should be applied. It must exist within the above purchase order. |

|

Begin Date | Enter or select a begin date for which this insurance type should apply. |

|

End Date | Enter or select an end date for which this insurance type should apply. |

|

Required for Payment | Select if having this insurance type in effect is required for payment to this vendor. If required then a warning will be displayed in Vendor Invoice, Voucher and Payment Request if the Insurance has reached its End Date. |

| Carrier Name | Enter the name of the insurance carrier assigned to this type of insurance. | |

| Carrier ID |

Enter or select the identification code of the insurance carrier identified above. |

|

| Limits | Enter or select the required policy limits for this type of insurance. | |

|

Policy Number |

Enter or select the number of the policy assigned to this type of insurance. | |

| Pre-Expiration Email Configuration | Enter or select the Pre-Expiration Email Configuration for the email to be generated for this type of insurance. Leave empty if a pre-expiration notification is not required. | |

| Post-Expiration Email Configuration | Enter or select the Post-Expiration Email Configuration for the email to be generated for this type of insurance. Leave empty if a post-expiration notification is not required. | |

|

Max Notification Years | Enter or select the maximum years for email notification to be generated about this type of insurance. |

| Comment | Enter any text comments related to this insurance type instance. | |

|

Status | Select the status of the insurance type instance. |

Email Configurations

| Field | Description | |

|---|---|---|

|

Code |

Enter a code for the email configuration. This must be unique to the document instance but does not have to be globally unique. |

|

Name | Enter a name to describe the document. The name does not have to be unique. |

|

Source Document |

Enter or select a source document type. This is the BST11 document type associated with the email. |

|

Template |

Enter or select an active email template. A template defines the information, structure, and layout that will be included in emails. Only templates for the Source Document are available for selection |

|

Status | Select the status of the email configuration instance. |

Recipients

| Field | Description | |

|---|---|---|

| Type |

Select the type of recipient:

|

|

| Contact |

Enter or select a contact. Only active contacts for the Vendor and that have an email defined can be selected. This field is required when Type is Contact. |

|

| Employee |

Enter or select an employee. Only active employees that have an email defined can be selected. This field is required when Type is Employee. |

|

| Email Address |

When Type is Specified Address, enter a valid email address. |

|

| Email Distribution Group |

Enter or select an Email Distribution Group . Required when Type is Email Distribution Group. |

|

| To | Enter the intended recipient's name. Not available when Type is Email Distribution Group. | |

| CC | Enter the intended carbon copy recipient's name. Not available when Type is Email Distribution Group. | |

| BCC | Enter the intended blind carbon copy recipient's name. Not available when Type is Email Distribution Group. | |

| Reply to | Enter the intended reply to recipient's name. Not available when Type is Email Distribution Group. | |