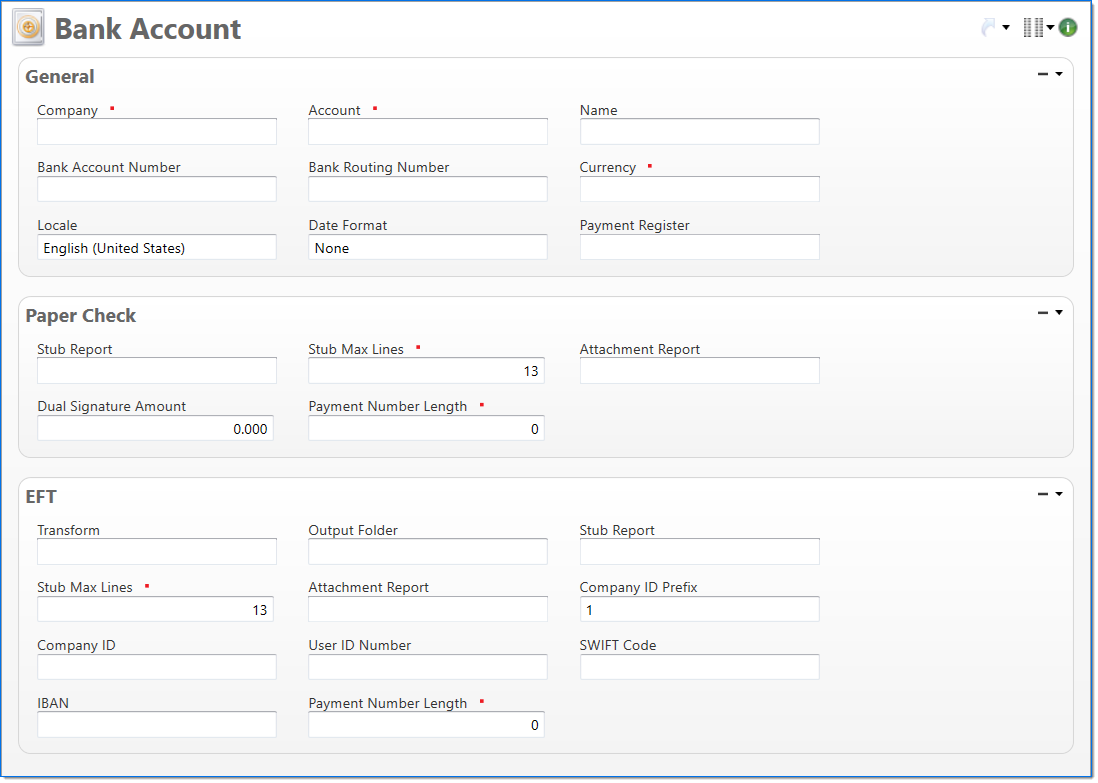

Bank Account

The Bank Account screen allows you to add and define bank accounts. The bank account defines the details of accounts that are held with banking institutions, such as the currency in which the account is held. This information is used during the payment process for checks and EFT payments.

General

In the General area, enter information to define the bank account.

| Field | Description | |

|---|---|---|

|

Company | Enter or select the company that owns the bank account. |

|

Account | Enter or select the account that will be used in the general ledger to represent this bank account. Only accounts with a Cash subsidiary type are available for selection. |

| Name | Displays the name of the selected account. | |

|

Bank Account Number | Enter the bank account number provided by your banking institution. This field is required if the EFT Transform is specified. For example, this bank account number will be included in the EFT file that is submitted to the bank. |

|

Bank Routing Number | Enter the banking institution's routing number. This field is required if the EFT Transform is specified. For example, this bank routing number will be included in the EFT file that is submitted to the bank. |

|

Currency | Enter or select the bank account currency. When a transaction, such as payment or deposit, uses this bank account then this will be used as the document currency of the transaction. |

| Locale |

Select the locale to be used for the check formatting. This defines the date and currency formats that will be used on checks issued from the bank account. |

|

| Date Format | Select a date format to use instead of the date format for your locale. This date format will be used on checks and check attachment reports issued from the bank account. This format is for use only for payments generated in Canada The alternate format only applies to the payment and any attachments. This capability supports the regulations of the Canadian Payments Association. | |

| Payment Register | Enter or select the report format used to print the payment register in the payment generation process. The locale is presented in ISO standard format by language and country to allow ease of localization. This table is pre-populated in BST11. |

|

Paper Check

In the Paper Check area, enter information about how paper checks will generate. The Payment Report supports 13 lines on the paper check stub.

| Field | Description | |

|---|---|---|

| Stub Report | Enter or select the report format used to print check stubs. The check stub lists the voucher's that are being paid by the check. | |

|

Stub Max Lines | Enter the maximum number of lines that print on a check stub. If the number of vouchers being paid exceeds this value, then the additional lines print on the Paper Check Attachment Report. |

|

Attachment Report |

Enter or select the report format used to print check attachments. | |

| Dual Signature Amount |

Enter the minimum value that requires a check to have two signatures. If you enter zero, all checks will require two signatures. This will be used in the payment generation process to determine the sort order of checks to print. Checks with a value equal to or greater than this value will be printed towards the beginning of the check run. |

|

|

Payment Number Length |

Enter the number of digits required for a payment number. This value is used to determine the number of leading zeros to add to a Payment Number entered in Payment Generation. A value between 0 (zero) and 16 can be entered. By default, 0 (zero) is selected. If 0 is entered, no leading zeros are added. If any other value is entered, the number of digits in the Payment Number is subtracted from the value and that many leading zeros are added; for example, if a Payment Number Length is 16 and 9999 is entered in Payment Generation for the First Payment Number, the payment number would be 0000000000009999. Likewise, the next generated payment number would adjust the number of necessary leading zeros and would be 0000000000010000. |

EFT

In the EFT area, enter information about EFT transactions.

| Field | Description | |||

|---|---|---|---|---|

| Transform |

Enter or select the process that transforms the EFT output into the format required by your banking institution. The available Transform processes supplied in BST11 are:

|

|||

|

Output Folder | Enter the folder that stores files created by the EFT Payment process. If the folder does not exist, the Payment Generation process creates it. | ||

| Stub Report | Enter or select the report format used to print EFT stubs. The check stub lists the vouchers that are being paid by the EFT payment. | |||

|

Stub Max Lines |

Enter the maximum number of lines that print on an EFT check. If the number of vouchers being paid exceeds this value, then the additional lines print on the EFT Attachment Report. |

||

| Attachment Report | Enter or select the report format used to print custom EFT attachments. | |||

| Company ID Prefix | Enter the prefix assigned by your banking institution. Your banking institution will dictate if the prefix is required in the EFT Output file. | |||

| Company ID | Enter the company identification code. This field will be used as the Immediate Origin value in the NACHA format. | |||

| User ID Number | Enter the banking user identification number. This number is issued by banking institutions in Australia. | |||

| SWIFT Code |

Enter the Society for Worldwide Interbank Financial Telecommunication (SWIFT) code. This field is used in conjunction with the IBAN code in EFT transformations, particularly for international money transfers. |

|||

| IBAN |

Enter the International Bank Account Number (IBAN.) This field is used in conjunction with the SWIFT code in EFT transformations, particularly for international money transfers. |

|||

|

Payment Number Length |

Enter the number of digits required for a payment number. This value is used to determine the number of leading zeros to add to a Payment Number entered in Payment Generation. A value between 0 (zero) and 16 can be entered. By default, 0 (zero) is selected. If 0 is entered, no leading zeros are added. If any other value is entered, the number of digits in the Payment Number is subtracted from the value and that many leading zeros are added; for example, if a Payment Number Length is 16 and 9999 is entered in Payment Generation for the First Payment Number, the payment number would be 0000000000009999. Likewise, the next generated payment number would adjust the number of necessary leading zeros and would be 0000000000010000. |

||