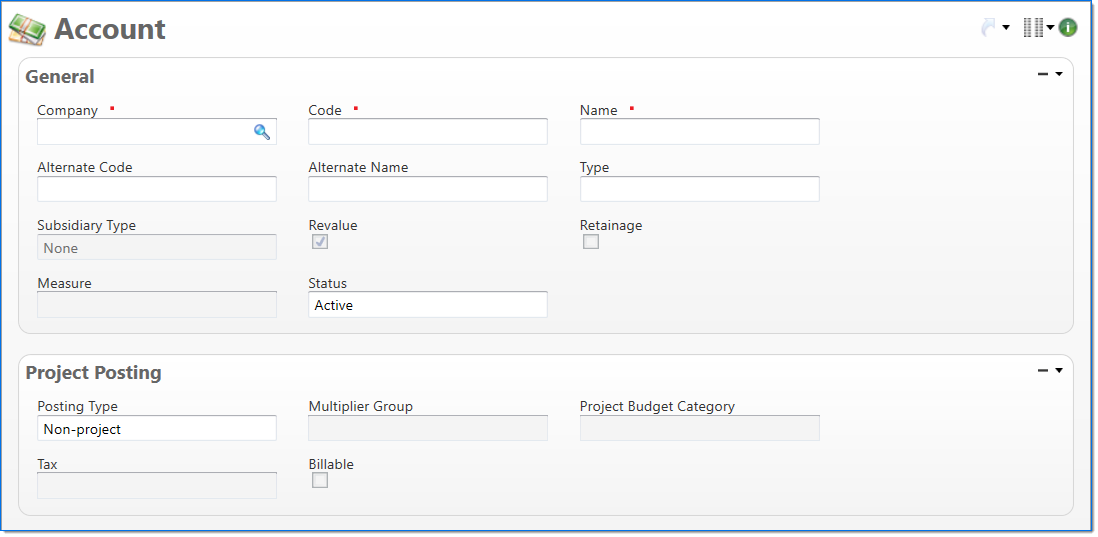

Account

The Account screen allows you to add and define general ledger accounts. Each account tracks the increases, decreases, and balance of accumulated transactions. It is also used throughout the system in the update process and in several posting groups.

General

In the General area, enter information to define the account.

| Field | Description | |

|---|---|---|

|

Company | Enter or select the company that owns the account. This selection cannot be changed once the document has been in a final state. |

|

Code | Enter a unique alphanumeric key to identify the document. Once a code has been entered and the document has been submitted to final, it typically cannot be changed. |

|

Name | Enter a name to describe the document. The name does not have to be unique. |

| Alternate Code | Enter an alternate alphanumeric key to identify the document. Up to 64 characters can be entered. If this field is empty and the Code field is updated, the Code value is entered. | |

| Alternate Name | Enter an alternate name to describe the document instance. If this field is empty and the Name field is updated, the Name value is entered. | |

| Type | Select one of the following account types: Asset, Expense, Liability, Equity, Revenue, or Statistical . Account types determine how each account is processed when used in a transaction. This selection cannot be changed once the document has been in a final state. | |

| Subsidiary Type |

Select the type of subsidiary data to store when the account is used in a transaction. This field is only available for Asset and Liability account types. This selection cannot be changed once the document has been in a final state.

|

|

| Revalue |

Select if the account should be included in the Unrealized Gain/Loss Currency Revaluation process. This field is only available for Asset and Liability account types. If not selected, the account's company and base currency values will not be revalued with the current currency revaluation rates. |

|

| Retainage | Select if the account is used to track retainage amounts due from clients. This field is only available when the subsidiary type is Project Receivable. | |

| Measure | Select if the account is used to track quantities. This field is only available when the type is Statistical. | |

| Status | Select the status of the document. | |

Project Posting

In the Project Posting area, enter information about when transactions are posted to a project.

| Field | Description | |

|---|---|---|

| Posting Type |

Select one of the following posting types: Non-project, Chargeable Task, Non-chargeable Task, and Labor. This selection controls if account entries should post through to the project system. It also effects which input documents can use this type of account. It also limits the type of project tasks that can use this type of account. This field is only available for Expense and Asset account types. |

|

| Multiplier Group | Enter or select the multiplier group. This selection determines the default multiplier used for the account in project transactions. This field is only available when the posting type is Chargeable Task, Non-chargeable Task, or Labor. | |

| Project Budget Category | Enter or select the project budget category. This field is only available when the posting type is Chargeable Task, Non-chargeable Task, or Labor posting type. | |

| Tax |

Enter or select a tax. This is used as an override during the billing process to bill expenses charged to this account at a specific tax rate. Only taxes with the same tax system as the selected company are available. This field is only available when the posting type is Chargeable Task. |

|

| Billable | Select if transactions posted to the account are billable. Billable transactions are posted to the Bill detail table for later use in the billing process. This field is only available when the posting type is Chargeable Task. | |