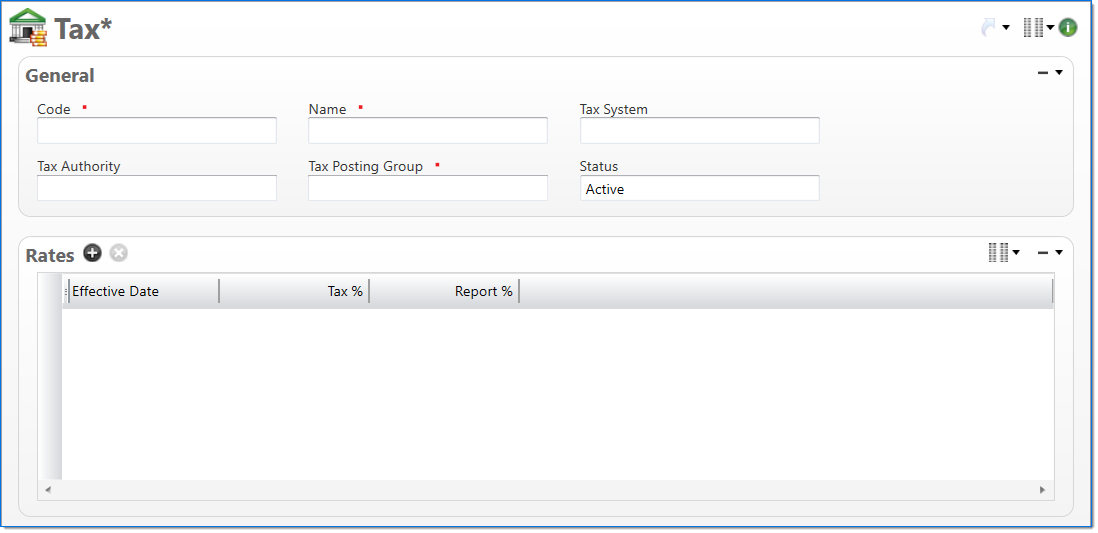

Tax

The Tax screen allows you to establish tax codes and assign rates to the codes. Tax codes and rates are used during financial transactions to calculate applicable tax amounts. During the transaction process, the tax rate with an Effective Date that is less than or equal to the transaction's document date is used. For example, when a tax code is used with a project, the system calculates the tax amount for the project's bills with the effective tax rates.

General

In the General area, enter tax information.

| Field | Description | |

|---|---|---|

|

Code | Enter a unique alphanumeric key to identify the document. Once a code has been entered and the document has been submitted to final, it typically cannot be changed. |

|

Name | Enter a name to describe the document. The name does not have to be unique. |

| Tax System |

Select if the tax system is Value Added Tax (VAT) or Direct Sales Tax. |

|

| Tax Authority |

Enter or select the tax authority. This is the entity that is responsible for tax collection. This field is used for report purposes only. |

|

|

Tax Posting Group |

Enter or select the tax posting group. The Tax Posting Group determines the general ledger accounts used to record tax during financial transactions. Only active Tax Posting Groups with a matching Tax System can be selected. |

| Status |

Select the status of the document. |

|

Rates

In the Rates area, enter rates information.

| Field | Description | |

|---|---|---|

| Effective Date |

Enter or select the date when the rate becomes effective. |

|

|

Tax % |

Enter the percentage used to calculate tax amounts. |

|

Report % |

Enter the reporting percentage. This is used on tax reports. The default is the Tax %. Certain conditions can exist (such as common market exemptions) where no tax is actually calculated on a purchase but the taxing authority requires that such items be shown in the tax report as two entries, one in and one out, at the tax report rate. |