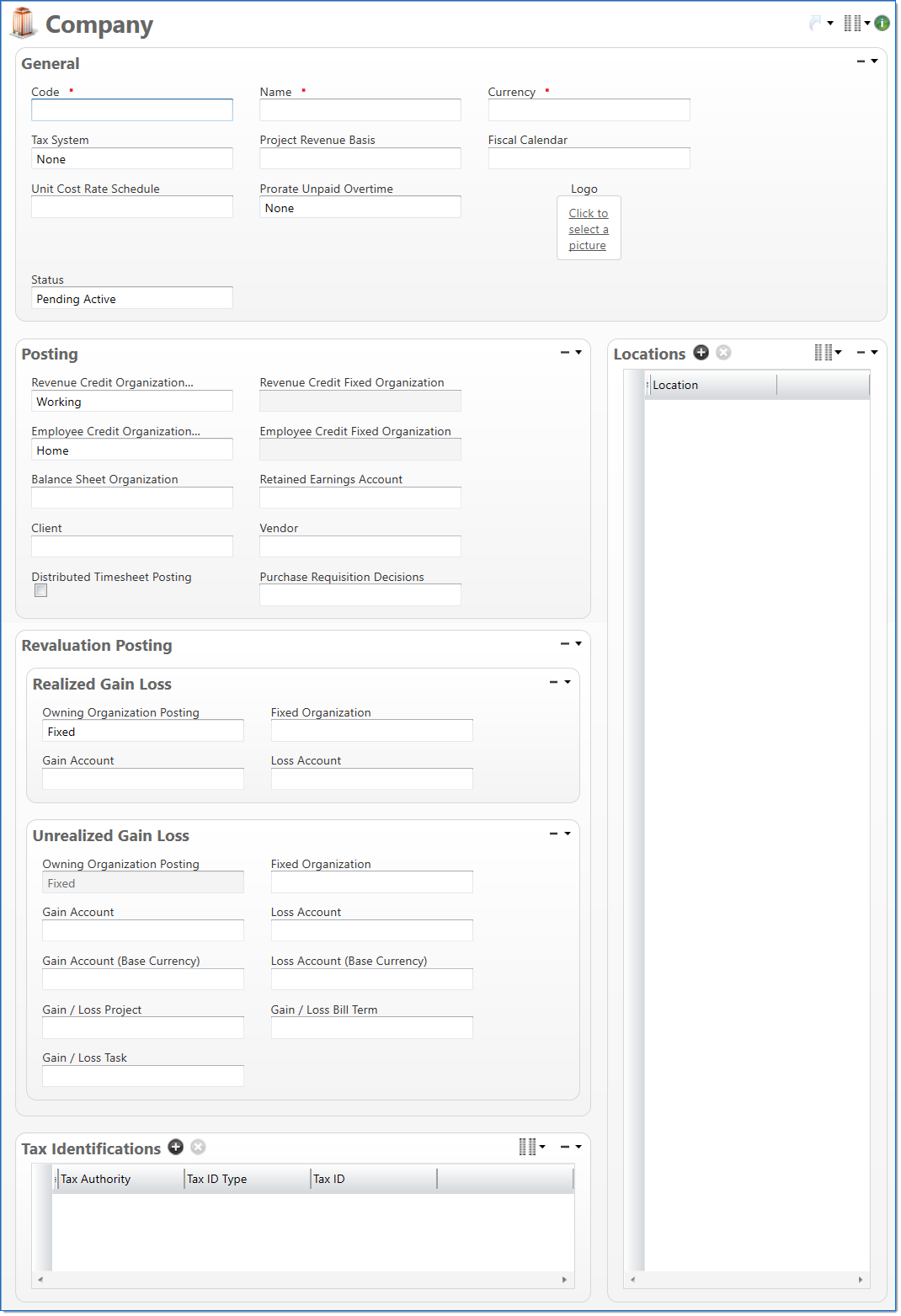

Company

The Company screen allows you to add and define companies. This defines the fiscal calendar and tax system that a company will use, as well as the accounts and organizations used when various financial transactions are posted.

General

In the General area, enter company information.

| Field | Description | |

|---|---|---|

|

Code | Enter a unique alphanumeric key to identify the document. Once a code has been entered and the document has been submitted to final, it typically cannot be changed. |

|

Name | Enter a name to describe the document. The name does not have to be unique. |

|

Currency | Enter or select an active currency. This is the currency used to record transaction values in company currency. |

| Tax System | Select the company tax system. Available selections include: Direct Sales Tax, None, and Value Added Tax (VAT). | |

|

Project Revenue Basis |

This required property indicates whether revenue on a project should be recognized and based on effort or cost. Select from options of Cost or Effort. This is used for new projects as their Project Revenue Basis is based on the project's company. |

|

Fiscal Calendar | Enter or select an active fiscal calendar for the company. This is used to determine fiscal year-to-date values in financial reports and the period when the company must perform their year end feature. This field is required for an active or pending active company. |

| Unit Cost Rate Schedule | Enter or select a unit cost rate schedule. This is used to calculate cost when units are processed. Only active unit cost rate schedules that have the same currency as the company can be selected. | |

| Prorate Unpaid Overtime |

Select the handling of unpaid overtime for salaried employees. Available selections include: Cost and None. The default value is None. For a short discussion of the proration of unpaid overtime for salaried employees, see |

|

|

Logo |

Select the link to include a logo image file to use on the Purchase Order report. The logo image should be 300dpi. The logo height is limited to 0.85 and the length is limited to 3.95. All RGB image formats are supported. |

|

| . | Status |

Select the status of the document. |

Posting

In the Posting area, enter accounts, organizations, and other information that will be used for various financial postings. For more information about organization setup, see Organization. For more information about account setup, see Account.

| Field | Description | |

|---|---|---|

| Revenue Credit Organization Posting |

Select if the Owning, Working or Fixed organization that should be used when posting Revenue Journal Entries. Owning uses the organization that owns the work in the project system and facilitates Intercompany Billing. Working uses the organization that performed the work in the project system. Fixed allows you to select an organization in Revenue Credit Fixed Organization. |

|

| Revenue Credit Fixed Organization |

Enter or select an active or pending active organization that belongs to the company to use in the Revenue Journal Entry process. This field is required when Fixed is selected in Revenue Credit Organization Posting. |

|

| Employee Credit Organization Posting |

Select if the Home or Fixed organization should be used for the credit side (i.e. liability) of transactions that result from posted timesheets. Home uses the employee's organization. Fixed allows you to select an organization in Employee Credit Fixed Organization. |

|

| Employee Credit Fixed Organization |

Enter or select an active or pending active organization that belongs to the company. This is used for the credit side (i.e. liability) of transactions that result from posted timesheets. This field is required when Fixed is selected in Employee Credit Organization Posting. |

|

|

Balance Sheet Organization | Enter or select an active or pending active organization that belongs to the company. This is used when project revenue is posted to the general ledger through the revenue journal entry process. |

|

Retained Earnings Account |

Enter or select an active or pending active account that belongs to the company. This is used during the end of year process to post retained earnings. Only accounts that belong to the company and have an Equity account type or a Liability account type with the subsidiary type of None can be selected. |

|

Client | Enter or select the client to represent the company. For intercompany transactions, this is used to represent a debt owed by this company in another company's general ledger. In the revaluation processes, this is used for entries posted to the realized gain / loss account and unrealized gain / loss account. |

|

Vendor | Enter or select the vendor to represent the company. For intercompany transactions, this is used to represent a debt owed to this company in another company's general ledger. In the revaluation processes, this is used for entries posted to the realized gain / loss account and unrealized gain / loss account. |

| Distributed Timesheet Posting |

Selecting this allows a company to engage Distributed Timesheet Posting. Selecting Distributed Timesheet Posting allows you to have the ability to split posting of a single timesheet to two different Posting Dates when a timesheet crosses a month end. Only timesheets where the employee's company has distributed timesheet posting selected can be considered for distributed posting. |

|

| Purchase Requisition Decisions | Enter or select a purchase requisition decision set. This defines the ways in which the company will handle the purchase requisition approval process. | |

Revaluation Posting

In the Revaluation Posting area, enter the accounts, organizations, and projects to use in the currency revaluation processes. For more information about organization setup, see Organization. For more information about account setup, see Account.

Realized Gain / Loss

| Field | Description | |

|---|---|---|

| Owning Organization Posting |

Select if Fixed or Owning organization should be used for currency revaluation differences in the Realized Gain/Loss process when the account being revalued has a subsidiary type of Project Receivable or Work in Process. When set to Fixed, the company's Realized Fixed Organization is used. When set to Owning, the organization on the project is used. |

|

| Fixed Organization |

Enter or select the organization to use when currency revaluation differences are posted to the Realized Gain/Loss account. Only active or pending active organizations assigned to the company can be selected. The selected organization is used when:

|

|

| Gain Account |

Enter or select the account to use to post currency revaluation differences in the Realized Gain process. Only active or pending active accounts that belong to the company with an Expense account type and a Non-Project posting type can be selected. |

|

| Loss Account | Enter or select the account to use to post currency revaluation differences in the Realized Loss process. Only active or pending active accounts that belong to the company with an Expense account type and a Non-Project posting type can be selected. | |

UNRealized Gain / Loss

| Field | Description | |

|---|---|---|

| Owning Organization Posting |

This is for display purposes only and will always display as Fixed. |

|

| Fixed Organization |

Enter or select the organization to use when currency revaluation differences are posted to the Unrealized Gain/Loss account. Only active or pending active organizations assigned to the company can be selected. |

|

| Gain Account |

Enter or select the account to use to post currency revaluation differences by the Unrealized Gain process. Only active or pending active accounts that belong to the company with an Expense account type and a Non-Project Posting type can be selected. |

|

| Loss Account | Enter or select the account to use to post currency revaluation differences by the Unrealized Loss process. Only active or pending active accounts that belong to the company with an Expense account type and a Non-Project Posting type can be selected. | |

| Gain Account (Base Currency) | Enter or select the Unrealized Gain Base Currency to post to a different account than Company Currency. This allows the Base Currency to be reported as a translation adjustment on the Balance Sheet, rather than the Company Currency Gain that gets reported on the Income Statement. | |

| Loss Account (Base Currency) | Enter or select the Unrealized Loss Base Currency to post to a different account than Company Currency. This allows the Base Currency to be reported as a translation adjustment on the Balance Sheet, rather than the Company Currency Loss that gets reported on the Income Statement. | |

| Gain/Loss Project |

Enter or select the project to use when posting revaluation differences to project related balance sheet accounts during the Unrealized Gain/Loss process. Only active and pending active projects that are owned by the company can be selected. |

|

| Gain/Loss Bill Term | Enter or select the bill term associated with the above project to use when posting revaluation differences to project related balance sheet accounts during the Unrealized Gain/Loss process. | |

| Gain/Loss Task | Enter or select the task associated with the above project to use when posting revaluation differences to project related balance sheet accounts during the Unrealized Gain/Loss process. | |

Locations

In the Locations area, enter or select locations related to the company. A location is used to define any physical location for the company. It is also used in Bill Remit Routings to indicate the address to which the client should mail their payments. For more information on how to define a location, see Location.

Tax Identifications

In the Tax Identifications area, enter the tax authorities, tax ID types, and taxes to use in the company tax calculation processes. For more information about tax authority setup, see Tax Authority. For more information about tax ID Type setup, see Tax ID Type.

| *Req'd | Field | Description |

|---|---|---|

| Tax Authority | Enter or select an active tax authority. This is the entity to which taxes withheld will be remitted. | |

| Tax ID Type | Enter or select an active tax ID type. This defines the type of tax that you will enter in the Tax ID field. | |

| Tax ID | Enter a tax identification number. For example, you might enter a VAT registration number. |