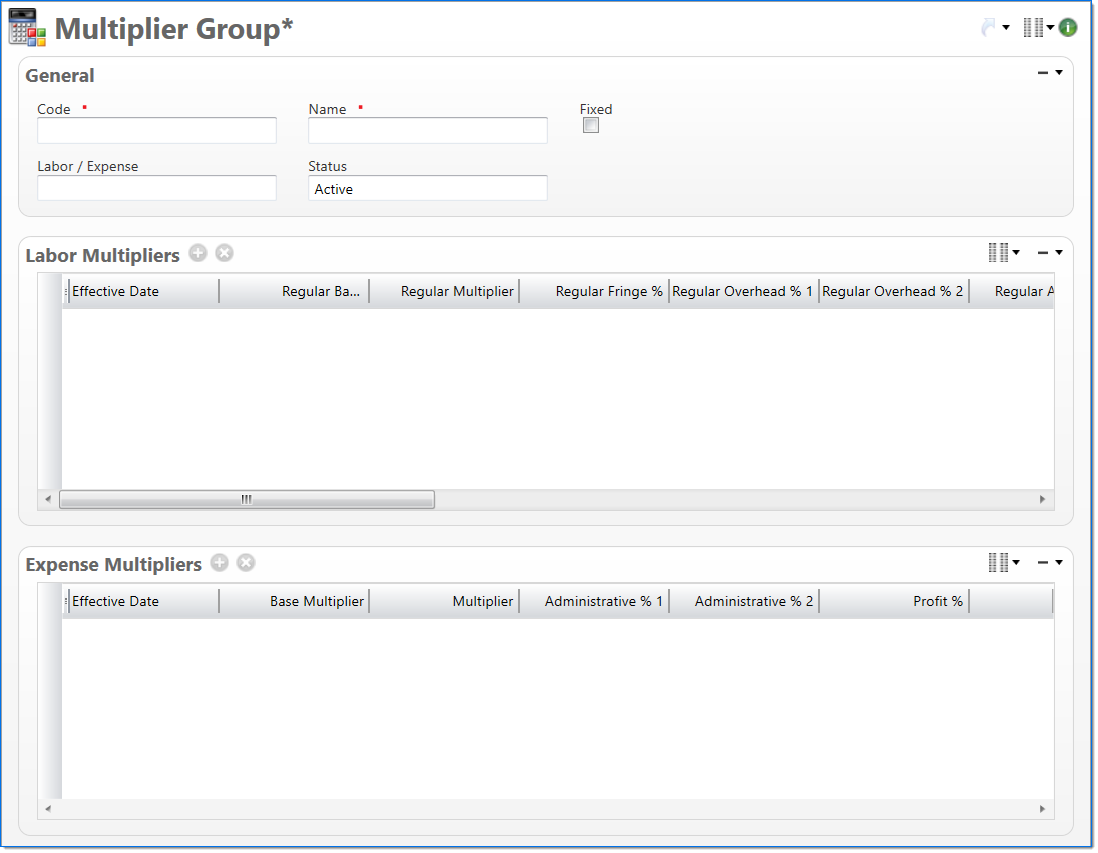

Multiplier Group

The Multiplier Group screen allows you to add and define a multiplier. A multiplier is defined as either labor or expense and is applied to projects and accounts. It is used to convert project cost to effort, which is used in revenue calculation and invoices.

General

In the General area, enter basic multiplier information.

| Field | Description | |

|---|---|---|

|

Code | Enter a unique alphanumeric key to identify the document. Once a code has been entered and the document has been submitted to final, it typically cannot be changed. |

|

Name | Enter a name to describe the document. The name does not have to be unique. |

| Fixed |

Select if this is a fixed multiplier. A fixed multiplier cannot be overridden. |

|

|

Labor/Expense |

Select if this multiplier is a Labor or Expense multiplier. Labor multipliers are used to mark up employee time and expense multipliers are used to mark up expenses and other direct charges. The Labor Multipliers area enables if you select Labor and the Expense Multipliers area enables if you select Expense. |

|

| Status |

Select the status of the document. |

|

Labor Multipliers

In the Labor Multipliers area, enter the rates associated with the labor multiplier by effective date. This area is only enabled when Labor is selected in the Labor/Expense field.

| Field | Description | |

|---|---|---|

| Effective Date | Enter or select the effective date of the multiplier. | |

|

Regular Base Multiplier | Enter the regular base multiplier. This field is used to calculate the regular multiplier. |

| Regular Multiplier |

Displays the regular multiplier. It is calculated as follows: |

|

|

Regular Fringe % |

Enter the regular fringe percent. The fringe percentage is applied to labor costs and is used to recover the costs associated with benefits provided to employees working for the corporation. |

|

Regular Overhead % 1 |

Enter the first regular overhead percent. The overhead percentage is applied to labor costs and is used to recover the costs of local corporate operations. |

|

Regular Overhead % 2 | Enter the second regular overhead percent. The overhead percentage is applied to labor costs and is used to recover the costs of local corporate operations. |

|

Regular Administrative % 1 |

Enter the first regular administrative percent. The administrative percentage is applied to labor costs and is used to recover the costs of the overall management and operation of a business. |

|

Regular Administrative % 2 | Enter the second regular administrative percent. The administrative percentage is applied to labor costs and is used to recover the costs of the overall management and operation of a business. |

|

Regular Profit % | Enter the regular profit percent. |

|

Premium Base Multiplier | Enter the overtime base multiplier. This field is used to calculate the premium labor multiplier. |

| Premium Multiplier |

Displays the premium multiplier. It is calculated as follows: |

|

|

Premium Fringe % | Enter the overtime fringe percent. The fringe percentage is applied to labor costs and is used to recover the costs associated with benefits provided to employees working for the corporation. |

|

Premium Overhead %1 | Enter the first overtime overhead percent. The overhead percentage is applied to labor costs and is used to recover the costs of local corporate operations. |

|

Premium Overhead % 2 | Enter the second overtime overhead percent. The overhead percentage is applied to labor costs and is used to recover the costs of local corporate operations. |

|

Premium Administrative % 1 | Enter the first overtime administrative percent. The administrative percentage is applied to labor costs and is used to recover the costs of the overall management and operation of a business. |

|

Premium Administrative % 2 | Enter the second overtime administrative percent. The administrative percentage is applied to labor costs and is used to recover the costs of the overall management and operation of a business. |

|

Premium Profit % | Enter the overtime profit percent. |

Expense Multipliers

In the Expense Multipliers area, enter the rates associated with the expense multiplier by effective date. This area is only enabled when Expense is selected in the Labor/Expense field.

| Field | Description | |

|---|---|---|

| Effective Date | Enter or select the effective date of the multiplier. | |

|

Base Multiplier | Enter the base multiplier. This field is used to calculate the multiplier. |

| Multiplier |

Displays the multiplier. It is calculated as follows: |

|

|

Administrative % 1 |

Enter the first administrative percent. The administrative percentage is applied to expense costs and is used to recover the costs of the overall management and operation of a business. |

|

Administrative % 2 | Enter the second administrative percent. The administrative percentage is applied to expense costs and is used to recover the costs of the overall management and operation of a business. |

|

Profit % | Enter the profit percent. |