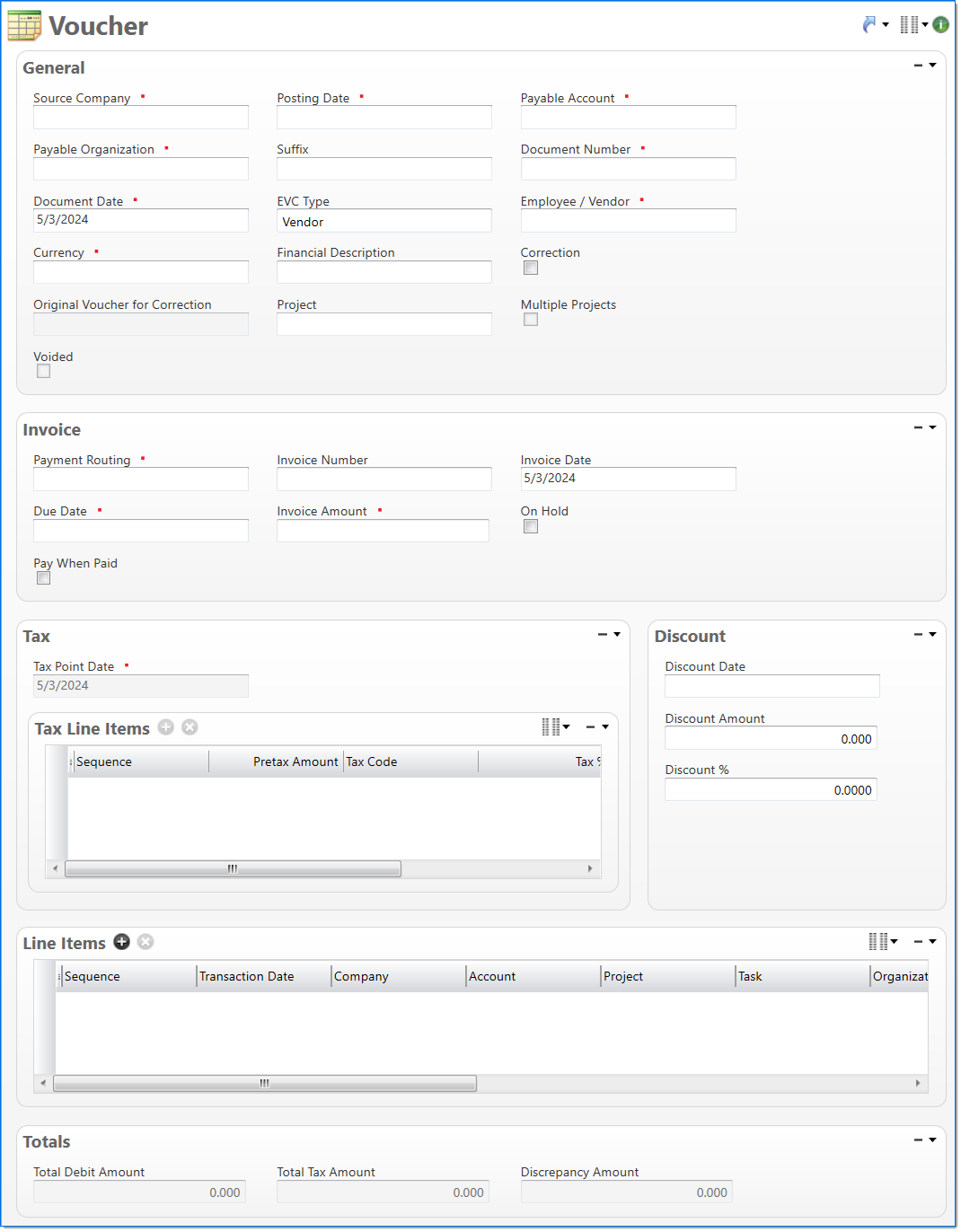

Voucher

The Voucher screen allows you to record an invoice received from a vendor or employee, which represents the amount due for goods or services delivered by the vendor or employee. The voucher is used to record the amounts due, due dates, discounts, and taxes. It also allows you to place a voucher on hold or post corrections to an existing voucher. The voucher can be selected for payment through Payment or Payment Request.

Additional line item details are available supporting purchase order line item, descriptions, and use tax properties are found in the Voucher Extended view. This is accessed through Voucher by clicking the View button and selecting Extended. Refer to Voucher Extended View for more information.

General

In the General area, enter voucher information.

| Field | Description | |||

|---|---|---|---|---|

|

Source Company |

Enter or select an active company. This is the company responsible for the document. This company records the liability for the vendor's invoice. If a value has been entered in Original Voucher for Correction, then this will display the source company from the original voucher. |

||

|

Posting Date |

Enter or select the posting date. This date is used to associate the document with a posting period. The posting date must allow this document type as an input and its posting period must be in an Open or Pending Close stage. Note: Posting Date will default to the first available open posting date. |

||

|

Payable Account |

Enter or select the account to use for the liability posted to the general ledger. Only active accounts where the subsidiary type is Accounts Payable or Intercompany Payable are available. If a value has been entered in Original Voucher for Correction, then this displays the payable account from the original voucher. |

||

|

Payable Organization |

Enter or select the organization to use for the liability posted to the payable account in the general and subsidiary ledgers. The organization must belong to the Source Company. If a value has been entered in Original Voucher for Correction, then this displays the payable organization from the original voucher. |

||

| Suffix |

Enter or select any active input document suffix that is available for the current document type. This can be used in reports to select or sort documents. |

|||

|

Document Number |

Enter a unique document number to identify this document. If a value has been entered in Original Voucher for Correction, then this displays the document number from the original voucher. |

||

|

Document Date | Enter or select the document date. The default is the current date. | ||

| EVC Type |

Select if the voucher is for an Employee or a Vendor. Changing the value of this field could change the values of following fields: Employee/Vendor, Due Date, Discount Date, Discount %, Discount Amount, and Pay When Paid. |

|||

|

Employee / Vendor |

Enter or select an active employee or vendor associated with the voucher. The selection in EVC Type defines if employees or vendors are available in this field. If a value has been entered in Original Voucher for Correction, then this will display the employee or vendor from the original voucher. |

||

|

Currency |

Enter or select the voucher currency. This defaults to the currency of the vendor or employee. If a value has been entered in Original Voucher for Correction, then this will display the currency from the original voucher. |

||

| Financial Description |

Enter text to further describe the nature of the transaction beyond the typical posting data. When the general ledger and subsidiary records are created, this description is used as the financial description for each line item unless overridden in the Line Items area. |

|||

| Correction |

Select if this is a correction to post an adjustment to an existing voucher. The correction will adjust the values held in the payable subsidiary ledger for the original voucher. |

|||

| Original Voucher for Correction |

Enter or select the voucher to be corrected. This is only available if Correction is selected. The available selections are limited to existing vouchers that match the selected Source Company, Payable Account, and Payable Organization. After selecting a voucher for correction, its original values are used to update the following fields:

When entering a voucher, if an existing voucher has the same values for Source Company, Payable Account, Payable Organization, Employee/Vendor, and Document Number, then the Original Voucher for Correction field will default to the matching voucher. |

|||

| Project | Enter or select the project. This is an optional field for determining which project the voucher is associated with for reporting purposes, or for checking to see if a Project Vendor Payment Terms document exists, which overrides any other Vendor Payment Terms assigned to that voucher. | |||

| Multiple Projects | This read-only field denotes whether the voucher contains more than one project at the line item level and automatically updates based on project values entered across all voucher line items. | |||

Invoice

In the Invoice area, enter information about the employee or vendor's invoice.

| Field | Description | |

|---|---|---|

| Invoice Number |

Enter an invoice number. This will be a number provided by the employee or vendor and will typically be the vendor's invoice number. |

|

| Invoice Date |

Enter or select the invoice date. This date will be provided by the employee or vendor and will typically be the vendor's invoice date. |

|

|

Due Date |

Enter or select the date the voucher is due for payment. This can be used to select vouchers for payment. For employees, this field defaults to the Invoice Date. For vendors, the default value is the Invoice Date plus the Due Days value defined in the Vendor Payment Terms. If the Project field is populated in the General section above, this date will be overridden to the Invoice Date plus the Due Days value defined any active Project Vendor Payment Terms document. |

|

Invoice Amount |

Enter the total value of the invoice. The voucher can not be processed unless this value equals the total value of the line items and VAT line items. For VAT invoices, this value will include the VAT value. |

|

Payment Routing |

Enter or select employee or vendor payment routing associated with this voucher. The payment routing determines the employee or vendor's mailing address used for payments. If a value has been entered in Original Voucher for Correction, then this will display the payment routing from the original voucher. |

| Payment Return Type | Enter or select an active payment return type. This column is used to categorize payments for tax return purposes. the default is blank. | |

| Payment Return Code | Enter or select an active payment return code. This column is used to further categorize payments within payment return type for tax return purposes. The available selections are limited based to the payment return codes defined for the selected Payment Return Type. | |

| On Hold |

Select if the voucher needs to be put in a hold state. This prevents payment of the voucher. This selection cannot be changed when Correction is selected and a value is selected in Original Voucher for Correction. In addition, this will display the On Hold selection from the original voucher. |

|

| Pay When Paid |

Select if the voucher is subject to pay when paid terms. This selection cannot be changed when Correction is selected. If a value has been entered in Original Voucher for Correction, this will display the Pay When Paid selection from the original voucher. If the EVC Type is changed to Employee, this field is automatically deselected. |

|

Tax

In the Tax area, enter line items to record the tax that has been charged on the vendor's invoice. This area is only available when the selected source company uses VAT as their tax system.

| Field | Description | |

|---|---|---|

|

Tax Point Date |

Enter or select the date of the supply of goods and services. |

| Tax Line Items |

The Tax Line Items is a list of codes and their amounts from the vendor's invoice.

|

|

Discount

In the Discount area, record any discount that may be available if the voucher is paid by the discount date. This is only applicable for vendors and is read only for employees.

| Field | Description | |

|---|---|---|

| Discount Date |

Enter or select the final date that the document is eligible for discount. For employees, this field defaults to the Invoice Date. For vendors, the default value is the Discount Days, which is defined in the Payment Terms for the vendor, added to the Invoice Date. |

|

| Discount Amount | Enter the discount amount that is available if the voucher is paid by the Discount Date. This value is always zero for employees. | |

| Discount % |

Enter the discount percent to apply to the invoice if it is paid on or before the date defined in the Discount Date. This field defaults to the value defined in the Payment Terms for the vendor. This value is always zero for employees. |

|

Line Items

In the Line Items area, enter the detail lines from the vendor's invoice.

The default columns are marked with an indicator (  ). For information on how to display the optional columns, see Manage Columns.

). For information on how to display the optional columns, see Manage Columns.

| Field | Description | |

|---|---|---|

|

Sequence | Displays the automatically generated sequence number that identifies the transaction. |

|

Transaction Date |

Enter or select the transaction date. This date is used when the transaction is posted to the general ledger and subsidiaries. The default is the Document Date. |

|

Company |

Enter or select the company. The default is the Source Company. Only the Source Company or active companies that are in an established intercompany relationship with the Source Company can be selected. Additionally, if a project is selected for the line item, only companies that are authorized to work on the project can be selected. |

|

Account |

Enter or select the account. Only active accounts that belong to the line item's Company and match the following criteria can be selected:

When the line item's Project and Task contain values, accounts must match the following additional criteria:

When the line item's Project contains a value and Task is empty, accounts must match the following additional criteria:

|

|

Project |

Enter or select the project. This field is only available when the line item's Account has a posting type of Non-Chargeable Task or Chargeable Task. When the line item's Account contains a value, projects must match the following additional criteria:

When the line item's Company and/or Organization contain a value, only projects where the company and organization are authorized for regular expenses are allowed. |

|

Task |

Enter or select a task. Only active tasks that are eligible for input, belong to the line item's Project, and match the following criteria can be selected: When the line item's Company and/or Organization contain a value, only tasks where the company and organization are authorized for regular expenses are allowed. When the line item's Account contains a value:

|

|

Organization |

Enter or select the organization. Only active organizations that belong to the line item's Company can be selected. When the line item's Project contains a value, only organizations that are authorized to work on the project can be selected. |

|

Amount |

Enter the debit amount to distribute to the line item's Account. |

|

Apportion Tax Amount |

Enter the amount of tax that should be evenly distributed. |

|

|

Debit Amount |

Enter the debit amount to distribute to the line item's Account. This is calculated as: Base Cost + Additional Cost + Other Charges + Tax Apportionment. |

|

|

Financial Description |

Enter text to further describe financial information about the line item beyond the typical posting data. If no description is entered, the Financial Description entered in the General area is used. This description is available in financial reporting. |

|

Project Description | Enter text to further describe project information about the line item beyond the typical posting data. This field is available only if the line item's Account has a posting type of Chargeable or Non-Chargeable Task. This description is available in project reporting. |

|

Use Tax Code |

Enter or select the use tax code. This contains the tax rate. This field is only available if the Source Company's tax system is Direct Sales Tax. |

|

Use Tax % |

Enter the current use tax percentage for this line item. This defaults to the rate defined in Tax Code. This field is only available if the Source Company's tax system is Direct Sales Tax. |

|

Use Tax Amount |

Enter the amount of use tax that should be charged on the line item. This field defaults to the calculated value: Debit Amount x (Use Tax % / 100). This field is only available if the Source Company's tax system is Direct Sales Tax. |

Totals

The Totals area displays the total values recorded on the voucher.

| Field | Description | |

|---|---|---|

| Total Debit Amount | Displays the total of all debit amounts in the line items. | |

| Total Tax Amount | Displays the total of all tax amounts in the VAT items. | |

| Discrepancy Amount |

Displays the discrepancy between the Invoice Amount and the values entered on the voucher. If there is a discrepancy, the voucher cannot be submitted. The discrepancy value is calculated as: Invoice Amount - (Total Debit Amount + Total Value Added Tax Amount). |

|