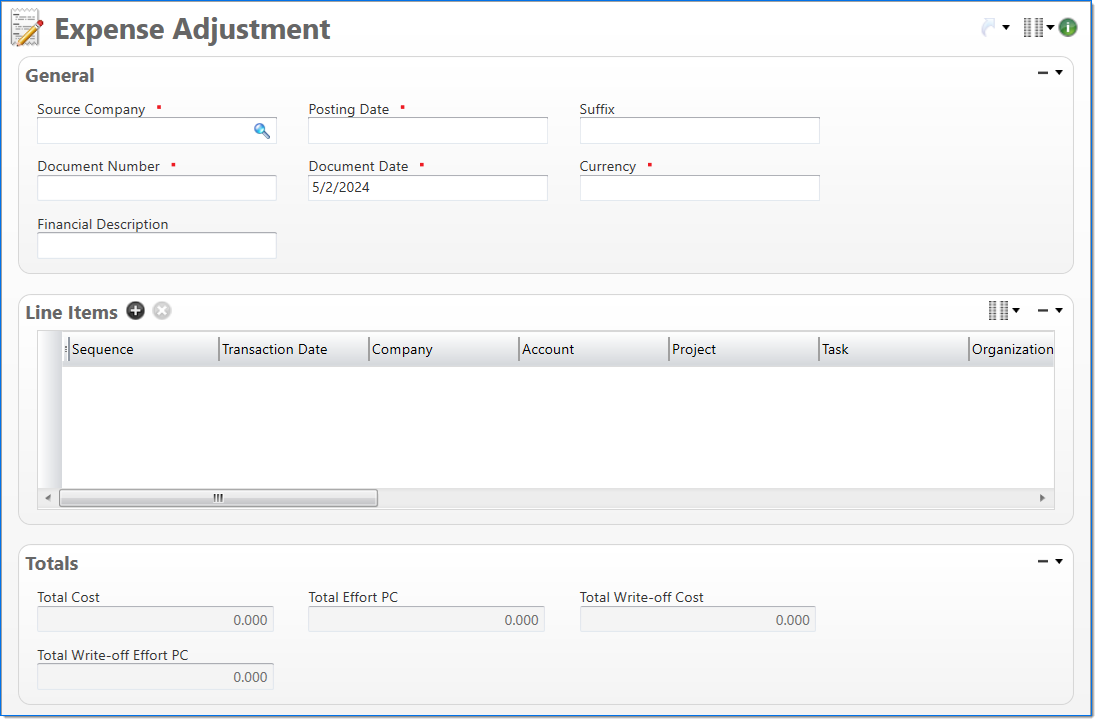

Expense Adjustment

The Expense Adjustment screen allows you to move cost and effort from one project and task combination to another. This updates the project and general ledger and also allows you to move costs between companies. When the Billable option is selected for a line item, the billing system is also updated.

General

In the General area, enter general information about the expense adjustment.

| Field | Description | |

|---|---|---|

|

Source Company | Enter or select an active or pending inactive company. This company is responsible for the expense adjustment. |

|

Posting Date | Enter or select the posting date. This date is used to associate the document with a posting period. The posting date must allow this document type as an input and its posting period must be in an Open or Pending Close stage. |

| Suffix |

Enter or select any active input document suffix that is available for the current document type. This can be used in reports to select or sort documents. |

|

|

Document Number | Enter a unique document number to identify this document.This field automatically prepopulates and be read-only if an auto-counter has been defined for this type of document. |

|

Document Date | Enter or select the document date. The default is the current date. |

|

Currency |

Enter or select the expense adjustment currency. If a currency is not selected, it is set to the currency of the Source Company. Only active currencies with an Effective Date that is less than or equal to the Document Date can be selected. |

| Financial Description | Enter text to further describe the nature of the transaction beyond the typical posting data. When the general ledger and subsidiary records are created, this description is used as the financial description for each line item unless overridden in the Line Items area. | |

Line Items

In the Line Items area, enter the detail lines. Each line item contains an amount to post to general ledger account and the project. At least one line item must have the Source Company selected. The selections in Company, Organization, Account, Project, and Task must be valid in relation to each other.

|

Note: Attachments can be added directly to a line item and, once appended, will display in the Line Item group from the Attachments panel. |

| Field | Description | |

|---|---|---|

|

Sequence | Displays the automatically generated sequence number that identifies the transaction. |

|

Transaction Date |

Enter or select the transaction date. This date is used when the transaction is posted to the general ledger and subsidiaries. The default is the Document Date. |

|

Company |

Enter or select the company. The default is the Source Company. Only the Source Company or active companies that are in an established intercompany relationship with the Source Company can be selected. Additionally, if a project is selected for the line item, only companies that are authorized to work on the project can be selected. |

|

Account |

Enter or select the account. Only active accounts that belong to the line item's Company and match the following criteria can be selected:

When the line item's Project and Task contain values, accounts must match the following additional criteria:

When the line item's Project contains a value and Task is empty, accounts must match the following additional criteria:

|

| Project |

Enter or select the project. This field is only available when the line item's Account has a posting type of Non-Chargeable Task or Chargeable Task. When the line item's Company and/or Organization contain a value, only projects where the company and organization are authorized for expense adjustments are allowed. |

|

| Task |

Enter or select a task. Only active tasks that are eligible for input, belong to the line item's Project, and match the following criteria can be selected: In addition, when the line item's Company and/or Organization contain a value, only tasks where the company and organization are authorized for expense adjustments are allowed. When the line item's Account contains a value:

|

|

|

Organization |

Enter or select the organization. Only active organizations that belong to the line item's Company can be selected. When the line item's Project contains a value, only organizations that are authorized to work on the project can be selected. |

| EVC Type |

Select if the voucher is for an Employee or a Vendor. |

|

|

Employee / Vendor |

Enter or select an active employee or vendor associated with the voucher. The selection in EVC Type defines if employees or vendors are available in this field. |

| Location |

Note: Location may be entered for a vendor and no change will occur. |

|

| Billable | Select if the adjustment could be written to the billing tables. | |

|

Cost | Enter the amount of cost to be adjusted. The cost is posted to the general ledger. |

| Effort PC | Enter the amount of effort to be adjusted. If a value is not entered, the cost is used to calculated the effort. | |

| Hold Cost | Displays the Cost to be held in document currency. This total only refers to Prebill hold hours. | |

| Hold Cost PC | Displays the cost to be held in project currency. | |

| Hold Cost CC | Displays the cost to be held in company currency. | |

| Hold Cost BC |

Displays the cost to be held in document currency. This field has the same precision as the base currency in the global settings. |

|

| Hold Effort PC |

Displays the effort to be held in project currency. Hold Effort is required if Hold Effort CC and Hold Effort BC are populated. |

|

| Hold Effort CC | Displays the effort to be held in company currency. | |

| Hold Effort BC |

Displays the effort to be held in document currency. This field has the same precision as the base currency in the global settings. |

|

| Write-off Cost | Enter the amount of cost to be written off. | |

| Write-off Effort | Enter the amount of effort to be written off. | |

|

Effort Basis | Select if the effort basis is None or Multiplier. This is used to calculate the effort and restricts the Effort Multiplier and Multiplier fields. |

| Effort Multiplier | Enter the effort multiplier. This field is enabled and required when Multiplier is selected in Effort Basis and is used to calculate the effort. | |

| Premium Effort Multiplier | Enter the premium effort multiplier. This field is enabled when Multiplier is selected in Effort Basis and is used to calculate the effort. | |

| Financial Description | Enter text to further describe financial information about the line item beyond the typical posting data. If no description is entered, the Financial Description entered in the General area is used. This description is available in financial reporting. | |

| Project Description |

Enter text to further describe project information about the line item beyond the typical posting data. This field is available only if the account subsidiary type is Work in Progress, or the account posting type is Chargeable or Non-Chargeable Task. This description is available in project reporting. |

|

Totals

The Totals area displays the total values recorded on the expense adjustment.

| Field | Description | |

|---|---|---|

| Total Cost | Displays a total cost of all of the line items. | |

| Total Effort | Displays a total effort of all the line items. | |

| Total Hold Cost | Displays the sum total of Held Cost in document currency from the line items. This total only refers to Prebill Hold Cost. | |

| Total Hold Effort |

Displays the sum of the Held Effort in project currency from line items. This total only refers to Prebill Hold Effort. Note: This total does not refer to a specific project’s currency. |

|

| Total Write-off Cost | Displays a total write-off cost of all the line items. | |

| Total Write-off Effort | Displays a total write-off effort of all the line items. | |