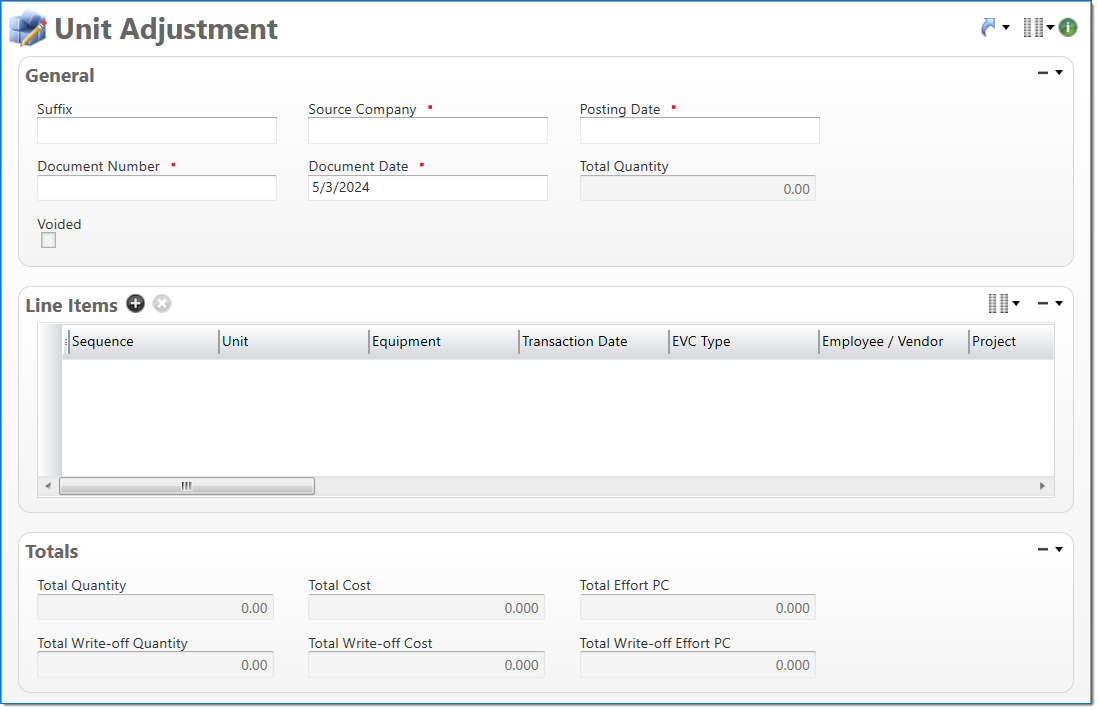

Unit Adjustment

The Unit Adjustment screen allows you to make corrections to unit entries.

General

In the General area, enter general information about the unit adjustment.

| Field | Description | |

|---|---|---|

| Suffix |

Enter or select any active input document suffix that is available for the current document type. This can be used in reports to select or sort documents. |

|

|

Source Company |

Enter or select an active or pending inactive company. This company is responsible for the unit adjustment. The selected Source Company must be defined in the unit posting group or equipment posting group for any selected Units or Equipment selected in the Line Items area. |

|

Posting Date | Enter or select the posting date. This date is used to associate the document with a posting period. The posting date must allow this document type as an input and its posting period must be in an Open or Pending Close stage. |

|

Document Number | Enter a unique document number to identify this document. This field automatically prepopulates and be read-only if an auto-counter has been defined for this type of document. |

|

Document Date | Enter or select the document date. The default is the current date. |

| Total Quantity | Displays the total quantity entered for units in the line items area. | |

| Voided | Indicates if the Unit Adjustment has been voided. Voided is selected when the Unit Adjustment Void is processed. | |

Line Items

In the Line Items area, enter the detail lines. The selections in Company, Organization, Project, and Task must be valid in relation to each other.

|

Note: Attachments can be added directly to a line item and, once appended, will display in the Line Item group from the Attachments panel. |

| Field | Description | |||

|---|---|---|---|---|

|

Sequence |

Displays the automatically generated sequence number that identifies the transaction. |

||

|

Unit |

Enter or select a unit. Only active units with the same source type as the company can be selected. When a Company is entered, only units that have a unit posting group that have an active posting configuration for the company can be selected. If Equipment is selected, the unit and equipment must have the same unit type. When this field is updated, the Equipment field is cleared. |

||

| Equipment |

Enter or select an equipment code. This field is required when a Unit that requires equipment is selected. Only active equipment with the same source type as the Company and that has the same unit type as the selected Unit can be selected. When a Company is entered, only equipment that has an equipment posting group that has an active posting configuration for the company can be selected. When this field is updated, the Company and Organization is updated to the home company and organization defined for the selected equipment. If the Unit field is updated, this field is cleared. |

|||

|

Transaction Date |

Enter or select the transaction date. This date is used when the transaction is posted to the general ledger and subsidiaries. The default is the current date. |

||

|

EVC Type |

Select if the unit adjustment is for an Employee or a Vendor. Changing the value of this field will clear the value of Employee / Vendor. |

||

|

Employee / Vendor |

Enter or select an active employee or vendor associated with the unit. The selection in EVC Type defines if employees or vendors are available in this field. If the EVC Type field is updated, this field is cleared. |

||

| Category |

Enter or select an active unit adjustment category. For an employee unit adjustment category, the EVC Type must be Employee and a valid account must exist for the Expense Report Category selection. |

|||

| Project |

Enter or select an active project. This field is required for labor type units. If the line item Unit contains a value:

If this value is updated and only one task exists on the project, the Task field is automatically updated. |

|||

| Task |

Enter or select a task. Only active tasks that are eligible for input, belong to the line item's Project, and match the following criteria can be selected: In addition, when the line item's Company and/or Organization contain a value, only tasks where the company and organization are authorized for expense adjustments are allowed. When the line item's Account contains a value:

|

|||

|

Company |

Enter or select a company. This field defaults to the Source Company. Only the Source Company or active or pending inactive companies that are in an established intercompany relationship with the Source Company can be selected. If the line item Unit contains a value:

If Unit or Equipment contain a value, only companies that have an active posting configuration in the unit posting group or equipment posting group can be selected. If the Equipment value is updated for the line item, this field is automatically updated to the home company defined for the selected equipment. |

||

|

Organization |

Enter or select an organization. Only active organizations that belong to the line item's Company can be selected. If the line item Unit contains a value:

If the Equipment value is updated for the line item, this field is automatically updated to the home organization defined for the selected equipment. |

||

| Location |

Enter or select an active location. When adding a new line item, Location defaults to the location from the employee expense report, if a location exists. Otherwise, Location will be blank. Location is cleared if EVC Type changes from Vendor to Employee or Employee to Vendor.

|

|||

|

Billable | Select if the adjustment could be written to the billing tables. | ||

|

Quantity | Enter the number of units for the line item. | ||

| Transaction Currency | Enter or select the currency to be used for this unit adjustment transaction. | |||

| Cost | Enter the amount of cost to be adjusted. The cost is posted to the general ledger. | |||

| Effort PC | Enter the amount of effort to be adjusted. If a value is not entered, the cost is used to calculated the effort. | |||

| Hold Quantity | Displays the Quantity to be held. This total only refers to Prebill Hold hours. | |||

| Hold Cost |

Displays the cost to be held in document currency. This total only refers to Prebill hold hours. Hold Cost is required if Hold Cost PC, Hold Cost CC and Hold Cost BC are populated. |

|||

| Hold Cost PC |

Displays the cost to be held in project currency. |

|||

| Hold Cost BC |

Displays the cost to be held in document currency. This field has the same precision as the base currency in the global settings. |

|||

| Hold Cost CC |

Displays the cost to be held in company currency. |

|||

| Hold Effort PC | Displays the Effort to be held in project currency. | |||

| Hold Effort CC | Displays the Effort to be held in company currency. | |||

| Hold Effort BC |

Displays the Effort to be held in base currency. This field has the same precision as the base currency in the global settings. |

|||

| Write-off Quantity | Enter the number of units to be written off. | |||

| Write-off Cost | Enter the amount of cost to be written off. | |||

| Write-off Effort | Enter the amount of effort to be written off. | |||

| Effective Cost Rate |

Enter the cost rate used to calculate Cost. Cost is calculated as Hours times the Effective Cost Rate. |

|||

| Regular Cost Rate | Enter the regular cost rate. This value is required when the Regular Cost Rate is entered in anything but the document currency. | |||

|

Effort Basis |

Select if the effort basis is None, Rate, or Multiplier.

|

||

| Effort Rate |

Enter the effort rate. This is used to calculate effort in project currency and is only available when the Effort Basis is set to Rate. |

|||

| Effort Multiplier |

Enter the effort multiplier. This is used to calculate effort and is only available when the Effort Basis is set to Multiplier. |

|||

| Project Description |

Enter text to further describe project information about the line item beyond the typical posting data. This field is available only if the account subsidiary type is Work in Progress, or the account posting type is Chargeable or Non-Chargeable Task. This description is available in project reporting. |

|||

Totals

The Totals area displays the total values recorded on the unit adjustment.

| Field | Description | |||

|---|---|---|---|---|

| Total Quantity | Displays the total quantity entered for the line items. | |||

| Total Cost | Displays a total cost of all of the line items. | |||

| Total Effort | Displays a total effort of all the line items. | |||

| Total Hold Quantity | Displays the sum total of Held Quantity from the line items. This total only refers to Prebill Hold Cost. | |||

| Total Hold Cost | Displays the sum total of Held Cost in document currency from the line items. This total only refers to Prebill Hold Cost. | |||

| Total Hold Effort |

Displays the sum of the Held Effort in project currency from line items. This total only refers to Prebill Hold Effort.

|

|||

| Total Write-off Quantity | Displays the total write-off quantity entered for the line items. | |||

| Total Write-off Cost | Displays a total write-off cost of all the line items. | |||

| Total Write-off Effort | Displays a total write-off effort of all the line items. | |||