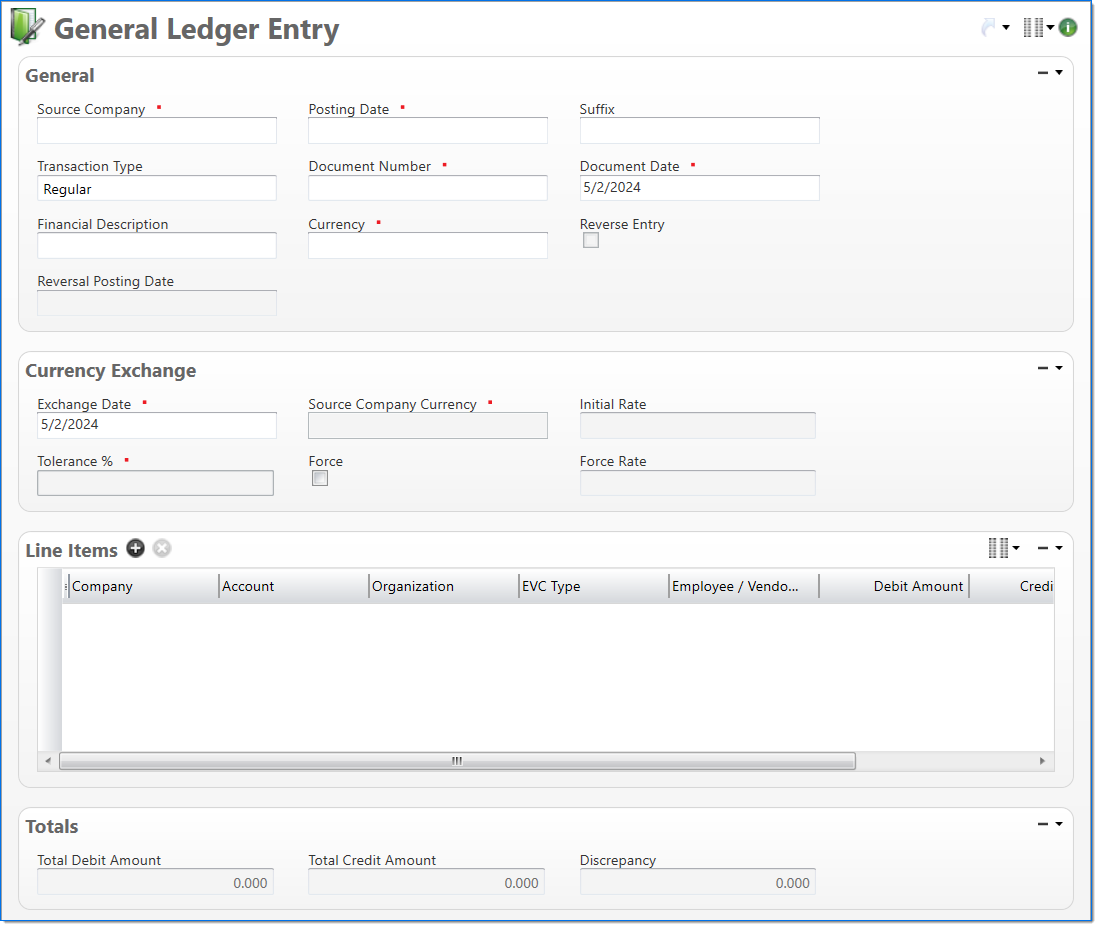

General Ledger Entry

The General Ledger Entry screen allows you to enter or adjust amounts in the general ledger. This does not update the project or subsidiary ledgers. Examples where a general ledger entry can be used include:

- Transfer revenue and expense balances to a company's retained earnings account. For more information, see Year End Criteria.

- Take on or adjust general ledger balances.

Because values are not posted to the project or subsidiary ledgers, it is not necessary to enter project or subsidiary information. Some general ledger entries may need to be reversed in a future posting period and the Reverse Entry options allows you to define when the entry should be reversed.

General

In the General area, enter general information about the general ledger entry.

| Field | Description | |

|---|---|---|

|

Source Company | Enter or select an active company. This is the company responsible for the document. |

|

Posting Date |

Enter or select the posting date. This date is used to associate the document with a posting period. The posting date must allow this document type as an input and its posting period must be in an Open or Pending Close stage. |

| Suffix |

Enter or select any active input document suffix that is available for the current document type. This can be used in reports to select or sort documents. |

|

| Transaction Type |

Select if the transaction is for Regular or Retained Earnings. This selection determines how transactions are recorded in the general ledger. The Retained Earnings type is used during the year end process to transfer values from revenue and expense accounts to the retained earnings account. |

|

|

Document Number |

Enter a unique document number to identify this document. |

|

Document Date |

Enter or select the document date. The default is the current date. |

| Financial Description | Enter text to further describe the nature of the transaction beyond the typical posting data. When the general ledger records are created, this description is used as the financial description for each line item unless overridden in the Line Items area. | |

|

Currency |

Enter or select the general ledger entry currency. This defaults to the currency of the Source Company. Only active currencies with an Effective Date that is less than or equal to the Document Date can be selected. |

| Reverse Entry |

Select if the entry needs to be reversed on a future posting date. If this item is selected, this process creates a new General Ledger document by copying the current document and negating the related amounts; and posts appropriately to the general ledger detail. |

|

| Reversal Posting Date |

Enter or select the posting date when the revenue adjustment entry should be reversed. This field is enabled and required when the Reverse Entry checkbox is selected. The reversal posting date must allow general ledger entries as an input, its posting period must be in an Open or Pending Close stage, and be greater than the selected Posting Date for the original general ledger entry. |

|

Currency Exchange

The Currency Exchange area displays the default Currency Exchange information used in the currency conversion between Document Currency and Source Company Currency as well as fields which will allow for a one time exchange rate to be defined.

| Req'd | Field | Description |

|---|---|---|

|

Exchange Date |

A required field that by default is set to the Document Date. This date can be changed to define a date other than the Document Date for which the currency conversion should be based. The available dates are determined by the Financial Input Date Validation fields in Global Settings. For example, if the Days Before Current Date and Days After Current Date are both set to 3 and today's date is 5/31/2023, only 5/28/2023 - 6/3/2023 are available for selection from the calendar. Dates that fall outside of the validation range are unavailable. |

|

Source Company Currency |

Displays the currency code and name of the Source Company of the associated input document. |

|

Initial Rate |

The currency exchange rate which will be used to convert from Document Currency to Source Company Currency unless a Force Rate is entered. |

|

Tolerance % |

Displays the allowable percent for which the Initial Rate is capable of differing from a manually entered Force Rate. |

|

Force |

Denotes that a Force Rate is to be applied on the document and upon selection enables the Force Rate field. |

|

|

Force Rate |

An override currency exchange rate to be used in place of the Initial Rate for the conversion of Document Currency to Source Company Currency. This rate must be within the Tolerance % of the Source Company Currency. |

Line Items

In the Line Items area, enter the detail lines. Each line item contains an amount to post to the general ledger. At least one line item must have the Source Company selected.

| Field | Description | |

|---|---|---|

|

Company |

Enter or select the company. The default is the Source Company. Only the Source Company or active companies that are in an established intercompany relationship with the Source Company can be selected. |

|

Account |

Enter or select the account. Only active accounts that belong to the line item's Company and match the following criteria can be selected:

|

|

Organization | Enter or select the organization. Only active organizations that belong to the line item's Company can be selected. |

|

EVC Type | Select if the general ledger entry is for an Employee, Vendor, or Client. |

|

Employee / Vendor / Client | Enter or select the active employee , vendor, or client associated with the general ledger entry. The selection in EVC Type defines if employees, vendors, or clients are available in this field. |

| Debit Amount | Enter the debit amount to post for the line item. | |

| Credit Amount | Enter the credit amount to post for the line item. | |

|

Financial Description | Enter text to further describe financial information about the line item beyond the typical posting data. If no description is entered, the Financial Description entered in the General area is used. This description is available in financial reporting. |

Totals

The Totals area displays amount totals for the line items.

| Field | Description | |

|---|---|---|

| Total Debit Amount | Displays the total of all the debit amounts in the line items. The document cannot be submitted until this field equals Total Credit Amount. | |

| Total Credit Amount | Displays the total of all the credit amounts in the line items. The document cannot be submitted until this field equals Total Debit Amount. | |

| Discrepancy | Displays any difference between the above two fields. Calculated as: Total Debit Amount – Total Credit Amount. | |