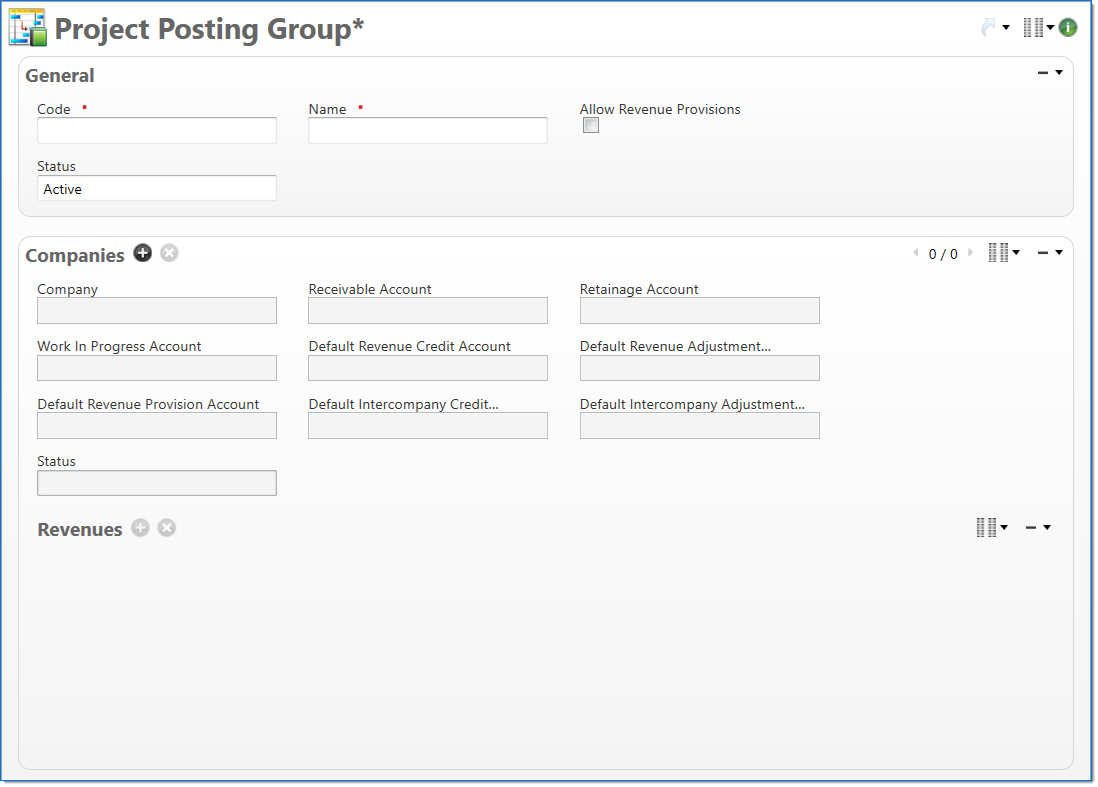

Project Posting Group

The Project Posting Group screen allows you to add and define project posting groups. Project posting groups are used to control revenue and billings postings to the general ledger for projects. Once submitted and moved to a final state, the project posting group code cannot be edited.

General

In the General area, enter basic project posting group information.

| Field | Description | |

|---|---|---|

|

Code | Enter a unique alphanumeric key to identify the document. Once a code has been entered and the document has been submitted to final, it typically cannot be changed. |

|

Name | Enter a name to describe the document. The name does not have to be unique. |

| Allow Revenue Provisions |

Select if revenue provisions should be allowed. This selection cannot be changed once the document has been in a final state. For additional information about how provisions work, see Provisions Overview. |

|

|

Status |

Select the status of the document. |

Companies

In the Companies area, define the accounts used to post different amounts. Groups of accounts are defined by the selected company. For more information about account setup, see AccountThe Revenue Account used for the Revenue Journal Entry posting to the General Ledger depends on whether it is a Revenue or Revenue Adjustment value and whether the value is for an intercompany entry (i.e. working company is not the owning company). In an intercompany situation, the accounts selected in the posting group for intercompany are first considered. These are used if they exist, if they do not then it will use the regular Revenue or Revenue Adjustment accounts.

| Field | Description | |

|---|---|---|

|

Company | Enter or select a company. This selection cannot be changed once the document has been in a final state. The company determines which accounts are available for selection. |

|

Receivable Account |

Enter or select a receivable account. This account is used during billing to record the amount that was billed to clients and needs to be received. Only accounts that belong to the company and have an Asset account type with the subsidiary type set to Project Receivable can be selected. |

|

Retainage Account |

Enter or select a retainage account. This account is used during billing to record the amount that was billed to the clients but will be retained and then later received after a specific action or event. Only accounts that belong to the company and have an Asset account type with the subsidiary type set to Project Receivable can be selected. |

|

Work in Progress Account |

Enter or select a work in progress account. This account is used by Revenue Journal Entry and billing. In Revenue Journal Entry, a positive amount is entered to record the work performed but not billed. In the billing process, a negative amount is entered to specify the amount billed to the client. Only accounts that belong to the company and have an Asset account type with the subsidiary type set to Work in Progress can be selected. |

|

Default Revenue Credit Account | Enter or select a default revenue credit account. Only active and pending active accounts with a Revenue account type can be selected. This account is used if a Revenue account has not been defined for the Budget Category in this posting group. |

|

Default Revenue Adjustment Credit Account | Enter or select a default revenue adjustment credit account. Only active and pending active accounts with a Revenue account type can be selected. This account is used if a Revenue Adjustment account has not been defined for the Budget Category in this posting group. |

| Default Revenue Provision Account | Enter or select a default revenue provision account. Only active and pending active accounts with a Revenue account type can be selected. This field is required when the Allow Revenue Provisions option is selected; this field is available when the Allow Revenue Provisions option is not selected, but a selection will not have an impact on the values posted to the General Ledger. This account is used if provisions are being posted to the General Ledger and a Provision account has not been defined for the Budget Category in this posting group. | |

| Default Intercompany Credit Account | Enter or select a default revenue credit account to be used for intercompany entries. Only active and pending active accounts with a Revenue account type can be selected. This account is used if an Intercompany Credit account has not been defined for the Budget Category in this posting group. If this account does not exist, the process will use the regular Revenue account. | |

| Default Intercompany Credit Adjustment Account | Enter or select a default revenue adjustment credit account to be used for intercompany entries. Only active and pending active accounts with a Revenue account type can be selected. This account is used if an Intercompany Credit Adjustment account has not been defined for the Budget Category in this posting group. If this account does not exist, the process will use the regular Revenue Adjustment account. | |

|

Status |

Select the status of the document. |

|

Revenues |

This area allows you to select the accounts used to track revenue posted by Revenue Journal Entry based on a budget category. This area is only visible when a company is displayed in Detail view.

|