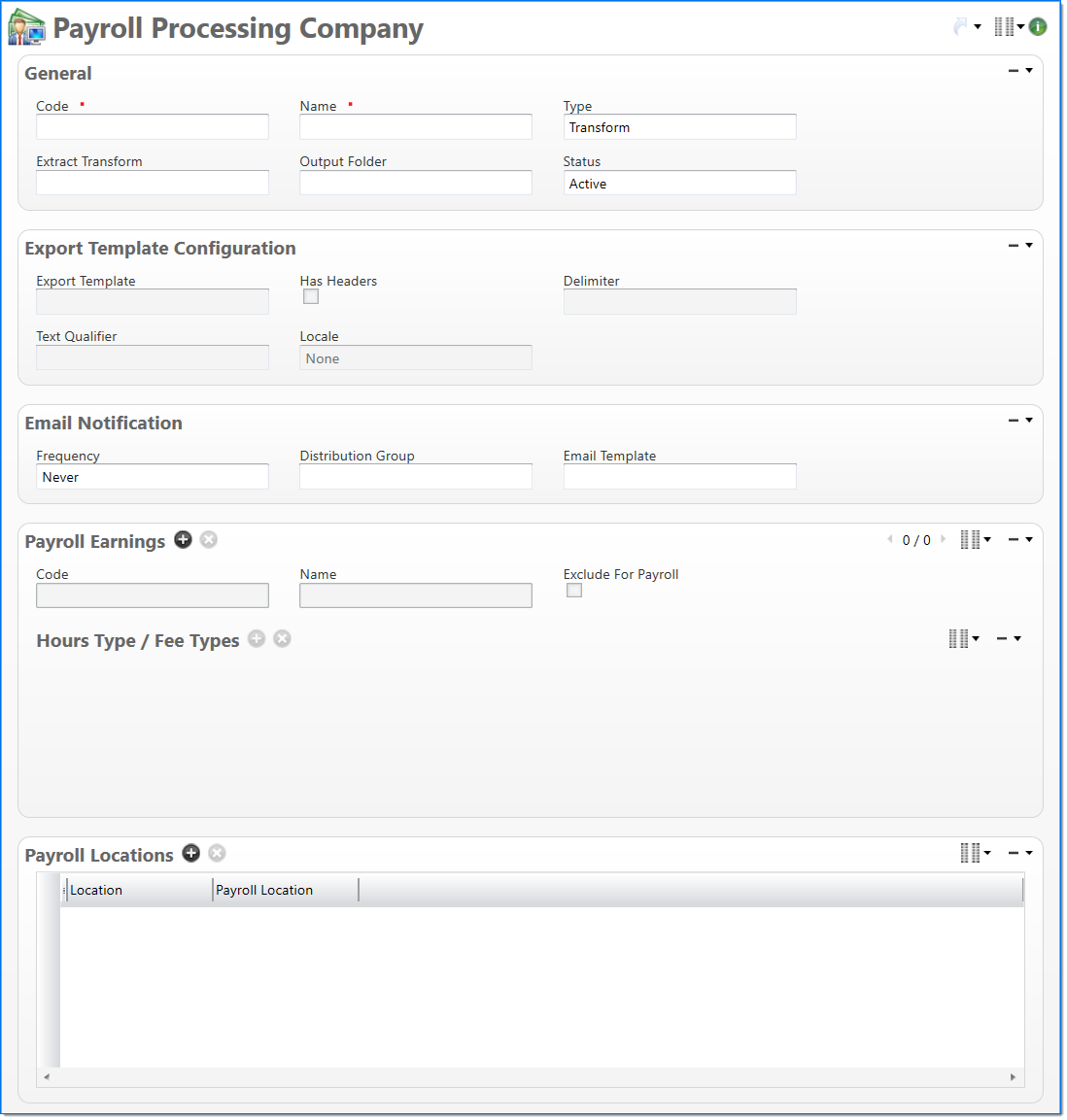

Payroll Processing Company

The Payroll Processing Company screen allows you to add and define the processing companies used to physically calculate payroll. Typically, these companies are external payroll processing services or third-party software installed locally to do payroll processing. Examples of payroll processing companies might be the ADP or PayChex service companies or payroll software such as the ABRA product.

Each payroll processing company has payroll earning codes associated with it that control handling of non-chargeable time. This screen also defines the non-chargeable (NC) earnings codes that the payroll processing company recognizes during payroll processing, and connects them to application's equivalent non-chargeable fee and hours types.

General

In the General area, enter the external payroll processing company information.

| Field | Description | |

|---|---|---|

|

Code | Enter a unique alphanumeric key to identify the document. Once a code has been entered and the document has been submitted to final, it typically cannot be changed. |

|

Name | Enter a name to describe the document. The name does not have to be unique. |

| Type |

Select the type of processing. The following options are available:

|

|

| Extract Transform |

Select the Transform process to use to extract the payroll hours file. For more information on this process, see How to Export Payroll Data Using the ADP Paydata Extract Transform. |

|

| Output Folder | Enter a file location to save the extracted payroll hours file. | |

| Status |

Select the status of the document. |

|

Export Template Configuration

In the Export Template Configuration area, select the type of data to export and how you would like the data to be formatted. This area is available when Type is Export Template. For more information about this process, see How to Export Payroll Data Using an Export Template.

| Field | Description | |

|---|---|---|

| Export Template | Enter or select an active export template. This includes the columns to include or exclude and the order of the columns. Each export template is based on and specific to the Document To Export and Export Format. | |

| Has Headers | Select if the exported file should have column headers. By default, this is selected. | |

|

Delimiter |

Select the type of delimiter to use in the exported file. Available delimiters include: Comma, Semicolon, Pipe, and Tab. By default, Comma is selected. |

|

Text Qualifier |

Select a text qualifier to use in the exported field. Available text qualifiers include: None, Double Quote, and Single Quote. By default, Double Quote is selected. |

| Locale |

Select the locale to use for number and date format in the exported file. By default, the locale of the Smart Client is selected. |

|

Email Notification

In the Email Notification area, select how often an email notification should be sent, what group should receive the email, and the email template used to create the email message. For additional information on email capabilities, see Manage Emails.

| Field | Description | |

|---|---|---|

| Frequency |

Select how often an email should be sent:

|

|

| Distribution Group |

Enter or select an active email distribution group. This is a predefined group of users that will receive email notifications. |

|

| Email Template |

Enter or select an active email template. A template defines the information, structure, and layout that will be included in emails. |

|

Payroll Earnings

In the Payroll Earnings area, enter the non-chargeable (NC) earnings code information.

| Field | Description | |||

|---|---|---|---|---|

|

Code |

Enter the earnings code for the payroll processing company. |

||

|

Name | Enter the name of the earnings code for the payroll processing company. | ||

| Exclude For Payroll | Select if the hours related to the hours type and fee types mapped to a specific earning code should be excluded from the payroll extract. | |||

| Hours Type / Fee Types |

For Hours Types / Fee Types, enter information about the hours type or fee type.

When a new Fee Type is added, a new row is added to the grid and both Regular and Overtime are selected. |

|||

| Regular |

Select this checkbox to have regular time added to payroll earnings. The default value is True. This field is selected for each Hours Type / Fee Type. |

|||

| Overtime |

Select this checkbox to have overtime added to payroll earnings. The default value is True. This field is selected for each Hours Type / Fee Type.

|

|||

Payroll Locations

In the Payroll Locations area, enter mappings between locations defined in BST11 and the locations for the Payroll Processing Company (e.g., ADP). These mappings are used during the Payroll Extract and Payroll Transform when needed. If a mapping is not needed, the output will use the location defined in BST11.

| Field | Description | |

|---|---|---|

|

Location |

Enter or select an active location. |

| Payroll Location |

Enter a string that corresponds to how the Payroll Processing Company refers to the BST11 Location. Up to 16 characters can be entered. |

|