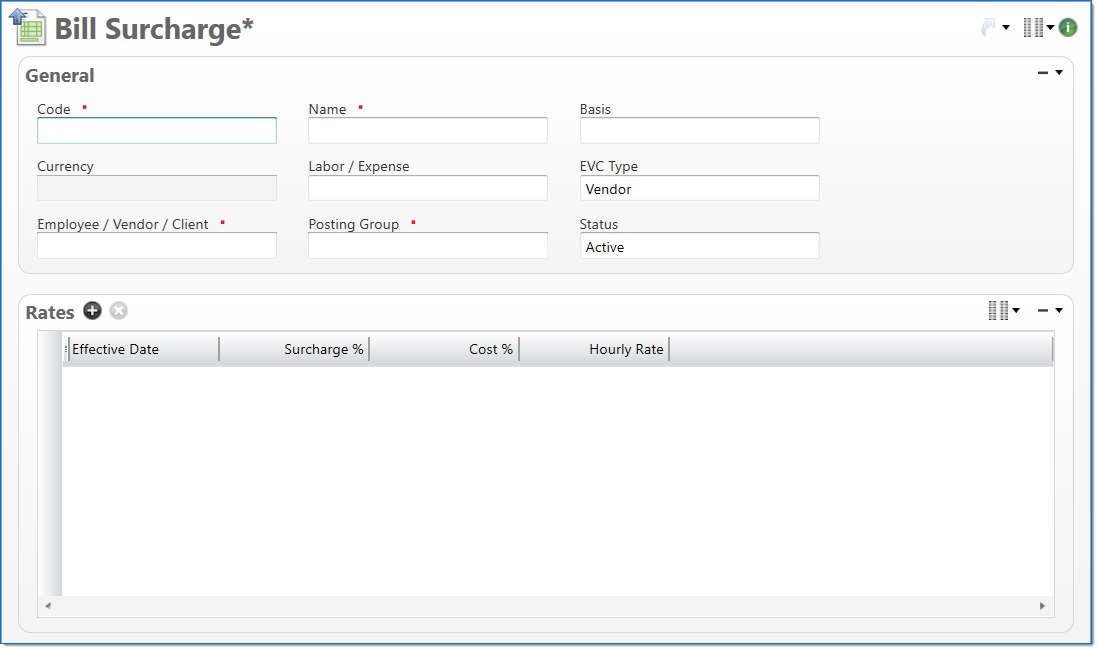

Bill Surcharge

The Bill Surcharge screen allows you to establish bill surcharge codes and assign rates to the codes. Bill surcharge codes and rates are used during bill transactions to calculate applicable bill surcharge amounts. During the transaction process, the bill surcharge rate with an Effective Date that is less than or equal to the transaction's document date is used. For example, when a bill surcharge code is used with a project, the system calculates the bill surcharge amount for the project's bills with the effective rates.

General

In the General area, enter bill surcharge information.

| Field | Description | |||

|---|---|---|---|---|

|

Code | Enter a unique alphanumeric key to identify the document. Once a code has been entered and the document has been submitted to final, it typically cannot be changed. | ||

|

Name | Enter a name to describe the document. The name does not have to be unique. | ||

| Basis |

Select the factor to be the basis for the surcharge calculation. The choices are: Cost, Effort, Pre-tax Amount or Billable Labor Hour. For Billable Labor Hour, surcharge is based on each billable labor hour. Basis is disabled when Bill Surcharge is in Final. |

|||

| Labor / Expense |

Select the value to be used for the surcharge calculation. The choices are: Labor, Expense, or All. There is no default. For a Surcharge Basis of Billable Labor Hour, Labor / Expense is Labor. This is calculated as: Total Billable Labor Hour (regular and OT hours) x Hourly Rate. If the Surcharge Basis changes, Labor / Expense is enabled to change. Expenses are excluded from this calculation. |

|||

| Currency |

Currency is required when Surcharge Basis is Billable Labor Hour or else currency is not required and disabled. For a Surcharge Basis of Billable Labor Hour, this determines the currency of the hourly rate, which must be the same as project currency.

|

|||

| EVC Type | Select if the surcharge posting is to an Employee, Vendor, or Client. | |||

|

Employee / Vendor / Client | Enter or select an active employee, vendor, or client to be associated with the credit side of the surcharge. The selection in EVC Type defines if employees, vendors, or clients are available in this field. | ||

|

Posting Group |

Enter or select the bill surcharge posting group. The posting group determines the general ledger accounts used to record tax during financial transactions. Only active Posting Groups can be selected. |

||

| Status |

Select the status of the document. |

|||

Rates

In the Rates area, enter rates information.

| Field | Description | |

|---|---|---|

| Effective Date |

Enter or select the date when the rate becomes effective. |

|

|

Surcharge % |

Enter the percentage used to calculate the surcharge amount. This value may be negative in order to allow discounting. This is read-only and not required if Surcharge Basis is Billable Labor Hour. |

|

Cost % | Enter the percentage of the surcharge amount to be posted as cost. When the bill report calculates the surcharge and posts it as an expense adjustment, the surcharge value is the effort. The cost percent tells what percentage of that effort should be calculated as the cost. The maximum value = 100 and the minimum value = 0. |

| Hourly Rate |

Enter the Hourly Rate of the Surcharge Basis = Billable Labor Hour to be posted as the cost. The bill report calculates the surcharge. This value may be a negative value to cover discounts. This is required when Surcharge Basis = Billable Labor Hour. |

|