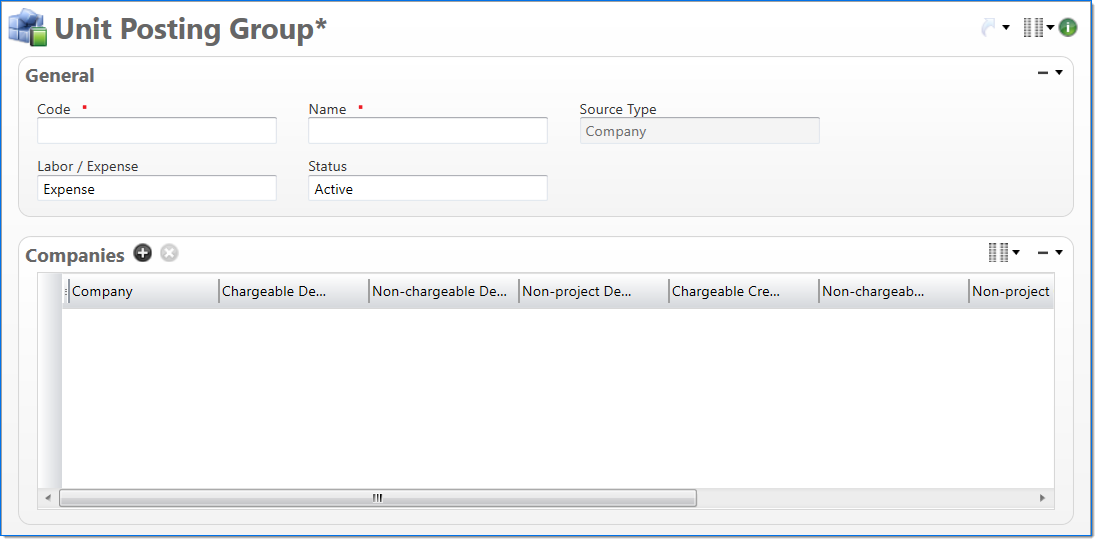

Unit Posting Group

The Unit Posting Group screen allows you to add and define unit posting groups. Unit posting groups are used to control how units that do not use equipment are posted. This includes the available list of companies and the general ledger accounts and credit organizations. Once submitted and moved to a final state, the unit posting group code cannot be edited.

General

In the General area, enter basic unit posting group information.

| Field | Description | |

|---|---|---|

|

Code | Enter a unique alphanumeric key to identify the document. Once a code has been entered and the document has been submitted to final, it typically cannot be changed. |

|

Name | Enter a name to describe the document. The name does not have to be unique. |

| Source Type |

Displays that the source of the unit is Company. |

|

| Labor / Expense |

Select if the unit is a Labor or Expense type unit. Once an option has been selected and the document has been submitted to final, this field cannot be changed. When this field is updated, all of the debit accounts in the Companies area are cleared. When changed to Labor, the Non-project Credit Account value is also cleared. |

|

| Status |

Select the status of the document. |

|

Companies

In the Companies area, define the accounts used to post the unit amounts. Groups of accounts are defined by the selected company. For more information about account setup, see Account

Only active companies that have been defined in the posting group can be entered for the unit. Once the document is submitted and moved to a final state, the companies cannot be deleted; to restrict new input against a company, update the Status field for the company's line item.

| Field | Description | |

|---|---|---|

|

Company |

Enter or select an active or pending active company. This selection cannot be changed once the document has been in a final state. The company determines which accounts are available for selection. When this field is updated, the accounts and organizations are cleared. |

|

Chargeable Debit Account |

Enter or select the default debit account to use when the unit is posted to a chargeable task. Only active or pending active accounts that belong to the Company can be selected. In addition, when Labor / Expense is Labor, only accounts with a labor posting type can be selected. When it is Expense, only accounts with a chargeable task posting type can be selected. |

|

Non-chargeable Debit Account |

Enter or select the default debit account to use when the unit is posted to a non-chargeable task. Only active or pending active accounts that belong to the Company can be selected. In addition, when Labor / Expense is Labor, only accounts with a labor posting type can be selected. When it is Expense, only accounts with a non-chargeable task posting type can be selected. |

| Non-project Debit Account |

Enter or select the default debit account to use when the unit is posted without a project or task. Only active or pending active accounts with an expense account type and a non-project posting type that belong to the Company can be selected. When Labor / Expense is Labor, this field is read-only. |

|

| Chargeable Credit Account |

Enter or select the default credit account to use when the unit is posted to a chargeable task. Only active or pending active accounts with an expense account type and a non-project posting group that belong to the Company can be selected. When Source Type is Company, this field is required and not read-only. When a unit is posted, the posting process uses the account from the row that matches the Source Company selected in Unit Entry. |

|

| Non-chargeable Credit Account |

Enter or select the default credit account to use when the unit is posted to a non-chargeable task. Only active or pending active accounts with an expense account type and a non-project posting type that belong to the Company can be selected. When Source Type is Company, this field is required and not read-only. When a unit it posted, the posting process uses the account from the row that matches the Source Company selected in Unit Entry. |

|

| Non-project Credit Account |

Enter or select the default credit account to use when the unit is posted without a project or task. Only active or pending active accounts with an expense account type and a non-project posting type that belong to the Company can be selected. When Labor / Expense is Expense and Source Type is Company, this field is required and not read-only. When a unit it posted, the posting process uses the account from the row that matches the Source Company selected in Unit Entry. |

|

| Credit Organization Posting |

Select if the Working or Fixed organization should be used when the unit is posted.

|

|

| Credit Fixed Organization |

Enter or select the default credit fixed organization to use when the Credit Organization Posting is Fixed or the debit company does not match the source company. When Source Type is Company, this field is required and not read-only. Only active or pending active organizations that belong to the Company can be selected. |

|

| Status |

Select the status of the document. |

|