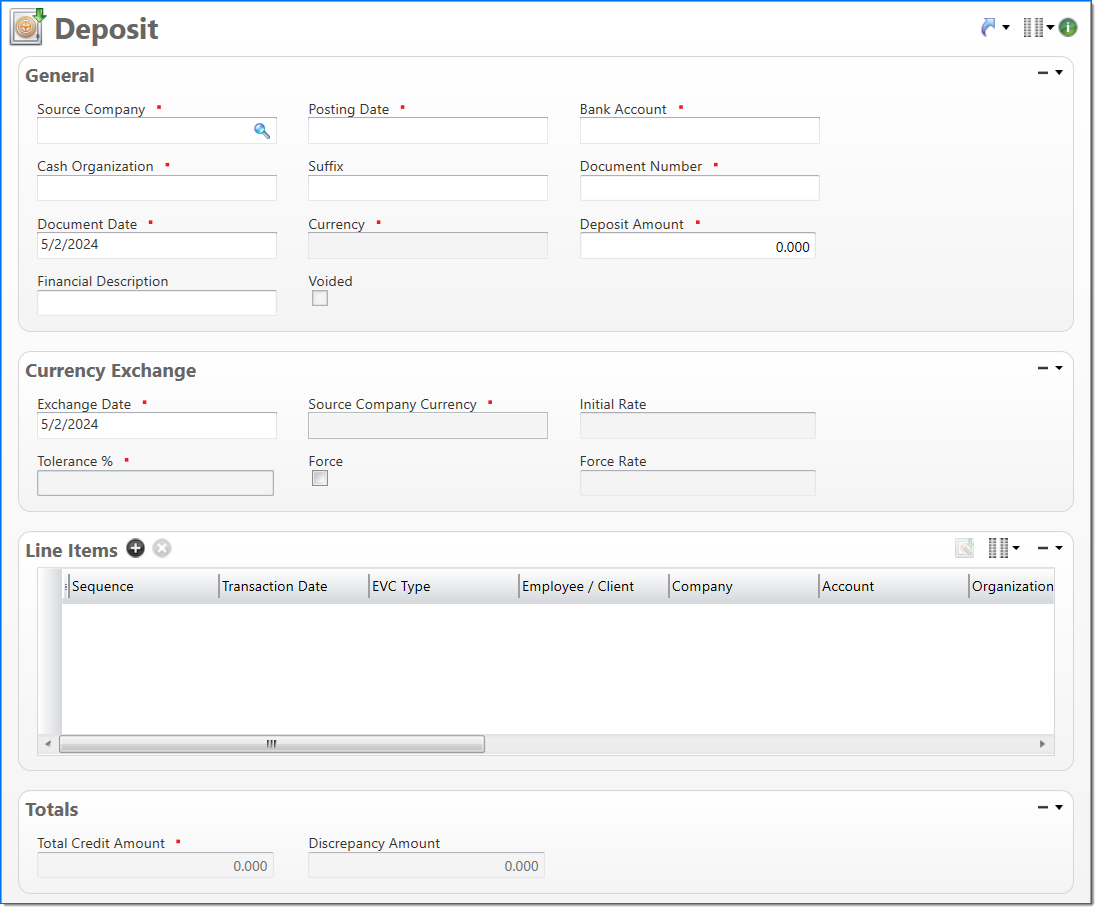

Deposit

The Deposit screen allows you to record payments received from employees or clients that will be deposited in a bank account. The payments received can be allocated against outstanding bills for employees and clients. In addition, the deposit allows the payment amounts to be distributed to general ledger accounts and, if applicable, the subsidiary ledgers and project.

General

In the General area, enter general information about the deposit.

| Field | Description | |||

|---|---|---|---|---|

|

Source Company | Enter or select an active company. This is the company responsible for the document. | ||

|

Posting Date | Enter or select the posting date. This date is used to associate the document with a posting period. The posting date must allow this document type as an input and its posting period must be in an Open or Pending Close stage. | ||

|

Bank Account | Enter or select the bank account that will receive the deposit. Only bank accounts for the Source Company and associated with an active general ledger account can be selected. | ||

|

Cash Organization |

Enter or select an organization. This is used when entries are posted to the Bank Account in the general ledger and subsidiary ledgers. Only active organizations for the Source Company can be selected. This is typically the Balance Sheet Organization defined for the Source Company. |

||

| Suffix |

Enter or select any active input document suffix that is available for the current document type. This can be used in reports to select or sort documents. |

|||

|

Document Number | Enter a unique document number to identify this document. This field automatically prepopulates and be read-only if an auto-counter has been defined for this type of document. |

||

|

Document Date | Enter or select the document date. The default is the current date. The available dates are determined by the Financial Input Date Validation fields in Global Settings. For example, if the Days Before Current Date and Days After Current Date are both set to 3 and today's date is 5/31/2023, only 5/28/2023 - 6/3/2023 are available for selection from the calendar. Dates that fall outside of the validation range are unavailable. |

||

|

Currency | Displays the currency of the selected Bank Account. | ||

|

Deposit Amount | Enter the total deposit amount. In order for the deposit to be submitted, the value of the line items must equal this amount. | ||

| Financial Description | Enter text to further describe the nature of the transaction beyond the typical posting data. When the general ledger and subsidiary records are created, this description is used as the financial description for each line item unless overridden in the Line Items area. | |||

| Voided |

Selected when a deposit has been voided.

|

|||

Currency Exchange

The Currency Exchange area displays the default Currency Exchange information used in the currency conversion between Document Currency and Source Company Currency as well as fields which will allow for a one time exchange rate to be defined.

| Req'd | Field | Description |

|---|---|---|

|

Exchange Date |

A required field that by default is set to the Document Date. This date can be changed to define a date other than the Document Date for which the currency conversion should be based. The available dates are determined by the Financial Input Date Validation fields in Global Settings. For example, if the Days Before Current Date and Days After Current Date are both set to 3 and today's date is 5/31/2023, only 5/28/2023 - 6/3/2023 are available for selection from the calendar. Dates that fall outside of the validation range are unavailable. |

|

Source Company Currency |

Displays the currency code and name of the Source Company of the associated input document. |

|

Initial Rate |

The currency exchange rate which will be used to convert from Document Currency to Source Company Currency unless a Force Rate is entered. |

|

Tolerance % |

Displays the allowable percent for which the Initial Rate is capable of differing from a manually entered Force Rate. |

|

Force |

Denotes that a Force Rate is to be applied on the document and upon selection enables the Force Rate field. |

|

|

Force Rate |

An override currency exchange rate to be used in place of the Initial Rate for the conversion of Document Currency to Source Company Currency. This rate must be within the Tolerance % of the Source Company Currency. |

Line Items

In the Line Items area, enter the detail amounts to post. Each line item amount will post to the general ledger and, if applicable, to the project.

Click the Deposit Assistant  button to access the Deposit Assistant. This allows you to search for accounts receivable instances being paid by an employee or client and then apply them as line items on the deposit. For information on how to add a line item with the Deposit Assistant, see Deposit Assistant.

button to access the Deposit Assistant. This allows you to search for accounts receivable instances being paid by an employee or client and then apply them as line items on the deposit. For information on how to add a line item with the Deposit Assistant, see Deposit Assistant.

| Field | Description | |

|---|---|---|

|

Sequence | Displays the automatically generated sequence number that identifies the transaction. |

|

Transaction Date |

Enter or select the transaction date. This date is used when the transaction is posted to the general ledger and subsidiaries. The default is the Document Date. The available dates are determined by the Financial Input Date Validation fields in Global Settings. For example, if the Days Before Current Date and Days After Current Date are both set to 3 and today's date is 5/31/2023, only 5/28/2023 - 6/3/2023 are available for selection from the calendar. Dates that fall outside of the validation range are unavailable. |

| EVC Type |

Select if the deposit is for an Employee or Client. |

|

|

Employee / Client | Enter or select an active employee or client associated with the deposit. The selection in EVC Type defines if employees or clients are available in this field. |

|

Company |

Enter or select the company. The default is the Source Company. Only the Source Company or active companies that are in an established intercompany relationship with the Source Company can be selected. |

|

Account |

Enter or select the account. Only active accounts that belong to the line item's Company and match the following criteria can be selected:

|

|

Organization | Enter or select the organization. Only active organizations that belong to the line item's Company can be selected. |

| Receivable Summary |

Enter or select a receivable summary instance. This is an additional method to select a bill instance to which the deposit should be applied. |

|

| Bill Number |

Enter the document number associated with the bill being paid by the employee or client. This will be required when the line item's Account has a receivable subsidiary type (i.e. Project Receivable, Other Receivable and Intercompany Receivable). If the Account has a receivable subsidiary type and if this number does not exist in the receivable subsidiary, then the payment will be treated as unallocated payment and a new receivable subsidiary instance is created. |

|

| Project |

Enter or select a project. This is required when the line item Account has a Project Receivable subsidiary type. Only active projects with the same currency as the document can be selected. |

|

| Bill Term |

Enter or select an active bill term. This will determine the client's billing address and payment terms and is required when the line item Account has a Project Receivable subsidiary type. |

|

|

Credit Amount | Enter the amount from the employee or client's payment that should be distributed to this line item. |

| Check Number | Enter the employee or client's check number. | |

| Check Date | Enter the date on the employee or client's check. | |

| Financial Description | Enter text to further describe financial information about the line item beyond the typical posting data. If no description is entered, the Financial Description entered in the General area is used. This description is available in financial reporting. | |

Totals

The Totals area displays the total values recorded on the deposit.

| Field | Description | |

|---|---|---|

|

Total Credit Amount | Displays the total of all the credit amounts in the line items. |

| Discrepancy Amount |

Displays the discrepancy amount between the Deposit Amount and the Total Credit. If there is a discrepancy, the deposit cannot be submitted. The discrepancy value is calculated as: the Deposit Amount - the Total Credit. |

|