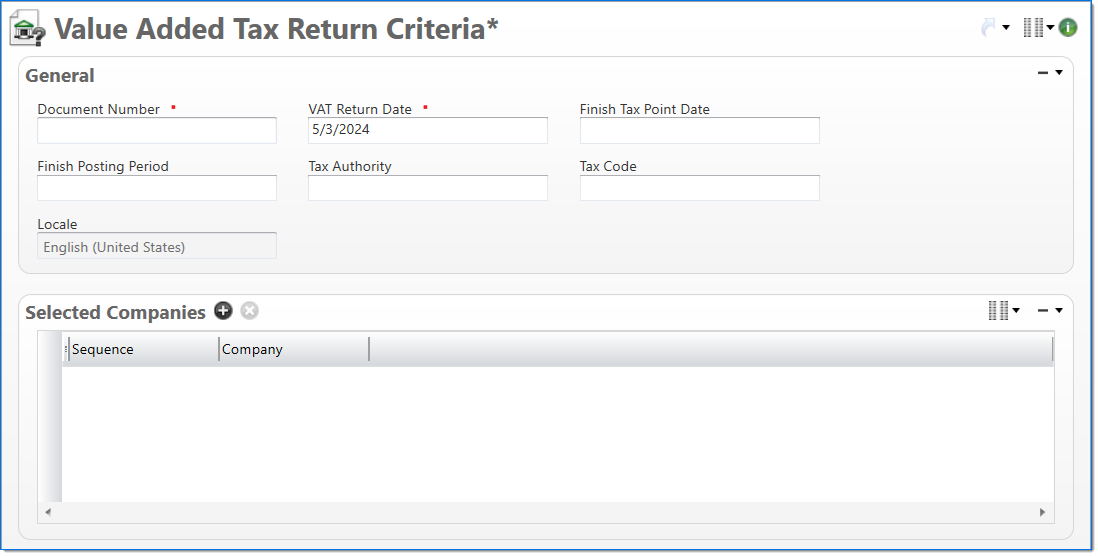

Value Added Tax Return Criteria

The Value Added Tax Return (VAT) Criteria screen allows you to define the input criteria used to select Value Added Tax Detail instances to include on the VAT tax return. The VAT Return process updates the VAT detail records with the VAT Return Date and generates the VAT Return report. For a VAT detail record to be included in a VAT Return, it can not have been included on a previous VAT Return. For more information about the report, see Value Added Tax Detail (Report).

General

In the General area, enter input criteria for the process.

| Field | Description | |

|---|---|---|

|

Document Number | Enter a unique document number to identify this document. This field automatically prepopulates and be read-only if an auto-counter has been defined for this type of document. |

|

VAT Return Date | Enter or select the tax return date. This date is typically provided by the taxing authority. |

| Finish Tax Point Date | Enter or select the tax point date. This date is used to restrict which VAT Detail records to include in the tax return. A value must be selected in this field or the Finish Posting Period field. | |

| Finish Posting Period | Enter or select a posting period. Only posting periods in a Adjustment, Closed, Open, or Pending Closed stage can be selected. The posting period is used to restrict which VAT Detail records to include in the tax return; VAT detail instances with a posting period that is equal or less than the Finish Posting Period will be included. A value must be selected in this field or the Finish Tax Point Date field. | |

| Tax Authority | Enter or select the tax authority. This is optional and is used to further restrict which VAT Detail records to include in the tax return. | |

| Tax Code | Enter or select the tax code. This is optional and is used to further restrict which VAT Detail records to include in the tax return. | |

| Locale |

Displays your locale based on your computer setting. This is used to define date and numeric formats. The locale is presented in ISO standard format by language and country to allow ease of localization. This table is pre-populated in BST11. |

|

Selected Companies

In the Selected Companies area, enter or select the companies to include in the tax return process. If no companies are selected, all companies are included in the process.