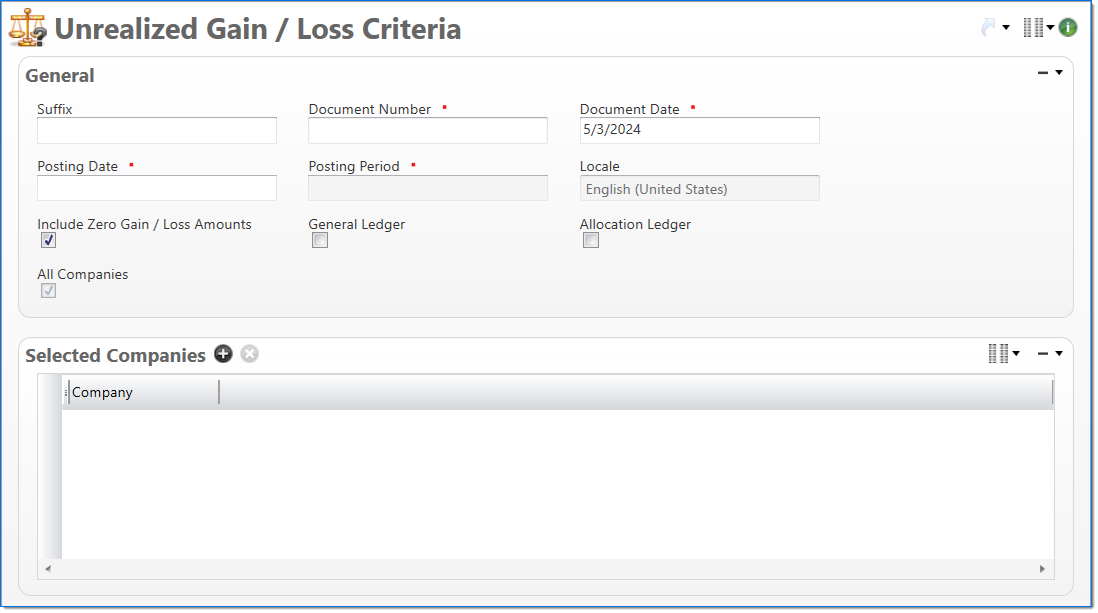

Unrealized Gain/Loss Criteria

The Unrealized Gain/Loss Criteria screen allows you to define the input criteria used in the Unrealized Gain/Loss process. This process is used to restate the company and base currencies values of Balance Sheet accounts for a specific period using the rates stored in the Currency Revaluation. The process creates journal entries to adjust the balances and generates the Unrealized Gain/Loss report. For more information about the report, see Unrealized Gain / Loss (Report).

For an account to be revalued, it must be an asset, liability, or equity type account. To exclude an account from revaluation, deselect the Revalue option on the account.

For an overview of currency, see Multi-Currency Overview.

General

In the General area, enter input criteria for the process.

| Field | Description | |

|---|---|---|

| Suffix |

Enter or select any active input document suffix that is available for the current document type. This can be used in reports to select or sort documents. |

|

|

Document Number | Enter a unique document number to identify this document. This is used as the Document Number on the journal entry for the revaluation. |

|

Document Date | Enter or select the document date. The default is the current date. This is used as the Document Date on the journal entry for the revaluation. |

|

Posting Date | Enter or select the posting date. This date is used to associate the document with a posting period. The posting date must allow this document type as an input and its posting period must be in an Open or Pending Close stage. This is used as the Posting Date on the journal entry for the revaluation. |

|

Posting Period | Displays the posting period associated with the selected posting date. |

|

Locale |

Displays your locale based on your computer setting. This is used to define date and numeric formats. The locale is presented in ISO standard format by language and country to allow ease of localization. This table is pre-populated in BST11. |

| Include Zero Gain / Loss Amounts | Select this option in the Unrealized Gain / Loss criteria to include any accounts with zero gains / losses on the Unrealized Gain / Loss reports. | |

| All Companies |

Displays if the process includes all companies in the extract file. By default, the All Companies check box is selected. When a line item is added to the Selected Companies grid, the value changes to unchecked. If all existing line items are deleted from the Selected Companies grid, the All Companies check box is automatically selected. While this property displays here, it is controlled by the contents of the Selected Companies grid and cannot be changed by clicking on it. |

|

Selected Companies

In the Selected Companies area, enter or select the companies to include in the revaluation process. If no companies are selected, all companies are included in the process.

Report Output

The Unrealized Gain / Loss report displays the gain or loss resulting from the currency revaluation process of 'unsettled' transactions. The currency revaluation process restates the company and base currencies values of Balance Sheet accounts for a specific period using the rates stored in the currency revaluation documents. The report is organized by company, and organization.

This report is generated as part of Unrealized Gain/Loss process. Because of this functionality, no summary level information is available. Further, no restrictions or sorts may be applied and a banner page will not be generated. This report can be attached to the Unrealized Gain/Loss Criteria document as a PDF for anyone with access to view.