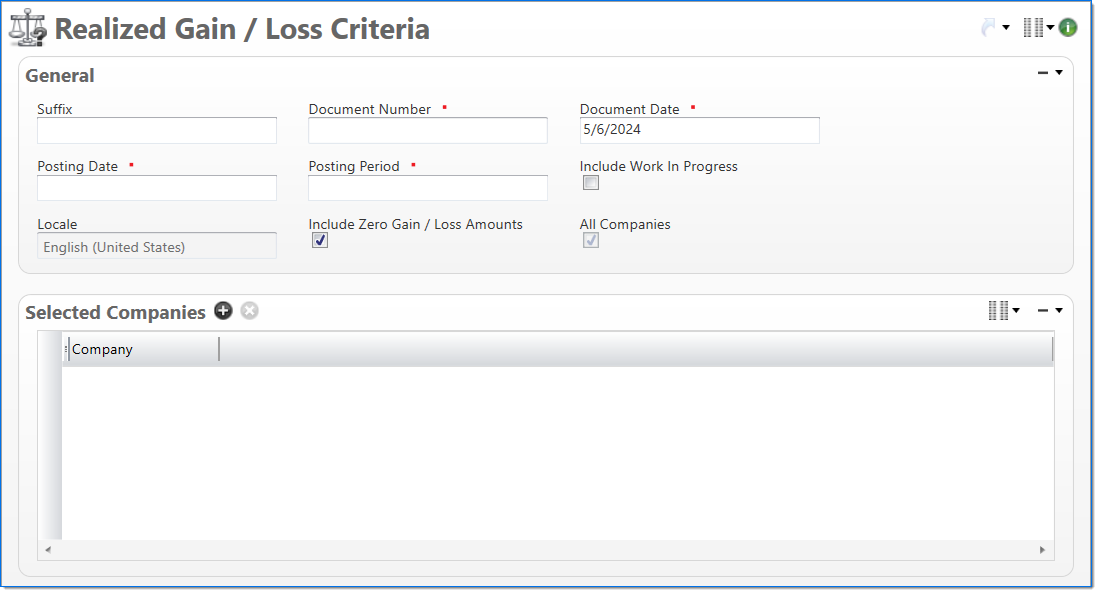

Realized Gain / Loss Criteria

The Realized Gain / Loss Criteria screen allows you to define the input criteria used in the Realized Gain / Loss Process. The process records currency realized gains and losses on documents that have been fully paid.

It selects documents from payables, receivables and optionally, work in progress, that have a zero balance in document currency but, due to currency fluctuations, have a balance in company or base currency. The process creates journal entries to adjust the balances and generates the Realized Gain / Loss report. For more information about the report, see Realized Gain / Loss (Report).

For an overview of currency, see Multi-Currency Overview.

General

In the General area, enter input criteria for the process.

| Field | Description | |

|---|---|---|

| Suffix |

Enter or select any active input document suffix that is available for the current document type. This can be used in reports to select or sort documents. |

|

|

Document Number |

Enter a unique document number to identify this document. This is also used as the Document Number on the journal entry for the revaluation. |

|

Document Date | Enter or select the document date. The default is the current date. This is used as the Document Date on the journal entry for the revaluation. |

|

Posting Date | Enter or select the posting date. This date is used to associate the document with a posting period. The posting date must allow this document type as an input and its posting period must be in an Open or Pending Close stage. This is used as the Posting Date on the journal entry for the revaluation. |

|

Posting Period |

Enter or select the posting period when the document's balance became zero (in document currency). When a Posting Date is selected, the available posting periods must be less than or equal to the Posting Date's posting period. |

| Include Work in Progress | Select if documents in the work in progress subsidiary will be included in the revaluation process. | |

| Locale |

Displays your locale based on your computer setting. This is used to define date and numeric formats. The locale is presented in ISO standard format by language and country to allow ease of localization. This table is pre-populated in BST11. |

|

| Include Zero Gain / Loss Amounts |

Select this option in the Realized Gain / Loss criteria to include any accounts with zero gains / losses on the Realized Gain / Loss reports. |

|

| All Companies |

Displays if the process includes all companies in the extract file. By default, the All Companies check box is selected. When a line item is added to the Selected Companies grid, the value changes to unchecked. If all existing line items are deleted from the Selected Companies grid, the All Companies check box is automatically selected. While this property displays here, it is controlled by the contents of the Selected Companies grid and cannot be changed by clicking on it. |

|

Selected Companies

In the Selected Companies area, enter or select the companies to include in the revaluation process. If no companies are selected, all companies are included in the process.